Xebec announces 2015 Q3 operating results

November 9, 2015

By CNW Telbec

November 9, 2015 - Xebec Adsorption Inc. (TSXV: XBC) ("Xebec"), a provider of gas purification and filtration solutions for the natural gas, field gas, biogas, helium, and hydrogen markets, announced its 2015 third quarter operating results today.

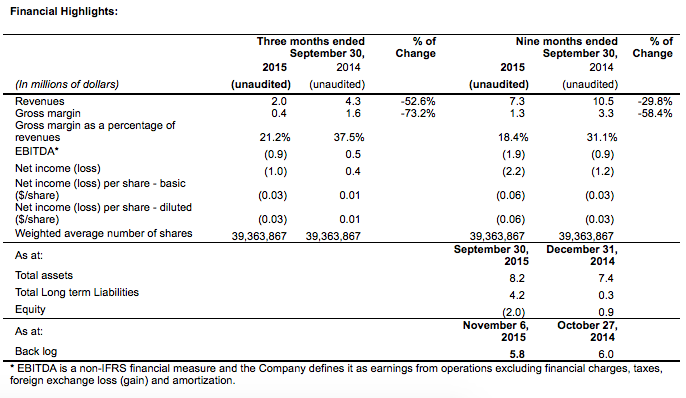

•Revenues of $2.0 million for the third quarter of 2015 compared to $4.3 million for the same quarter in 2014, a 52.6% decrease compared to the same period in 2014.

•Net loss of $1.0 million or $0.03/share for the three month period in 2015 compared to a net income of $0.4 million or $0.01/share for the same period in 2014.

Financial results

Revenues

Xebec posted revenues of $ 2.0 million for the third quarter of 2015, a 52.6 per cent decrease compared to $4.3 million in the third quarter of 2014. This decrease is mainly explained by lower sales in the Natural Gas Dryer segment and Gas Purification segment respectively by $(1.1) million and $(1.1) million, and no sales in the Associated Gas segment during this quarter compared to $0.2 million in the corresponding period last year.

Revenues were $7.3 million for the nine-month period ended September 30, 2015 compared to $10.5 million for the corresponding period. This decrease of $3.2 million is mainly due to lower sales in the Natural Gas Dryer segment, Gas Purification segment and Associated Gas segment by respectively $(1.0) million, $(1.5) million and $(0.9) million.

Order backlog

As of November 6, 2015, total order backlog stood at $5.8 million, compared to $6.0 million as at October 27, 2014.

Gross margin

Xebec’s gross margin for the third quarter of 2015 amounted to $0.4 million compared to $1.6 million for the same period in 2014. The decline versus the same period last year is mostly explained by the negative impact of fixed costs in connection with lower volume of sales.

For the nine-month period ended September 30, 2015, the total gross margin amounted to $1.3 million, compared to $3.3 million for the same period in 2014. Margins were mainly affected negatively in 2015 by the completion of a biogas project with a negative gross margin in Q2 2015.

EBITDA and net loss

The EBITDA for the third quarter of 2015 amounted to $(0.9) million compared to $0.5 million in the third quarter of 2014. This variation of the EBITDA is attributable to the decrease of $1.2 million in gross margin and an increase of research and development cost by $0.2 million.

For the nine-month period ended September 30, 2015, the EBITDA amounted to $(1.9) million compared to $(0.9) million in the third quarter of 2014. Despite the overall lower gross margin of $(2.0) million, better control of selling and administrative costs ($0.8 million), combined with a foreign exchange gain ($0.2 million) have contributed to reduce the difference on the EBITDA level compared to the same period last year.

Net loss for the third quarter of 2015 totalled $(1.0) million, or ($0.03) per share, compared to a net income of $0.4 million, or $0.01 per share for the same period in 2014. This higher net loss is explained by a lower gross margin of $1.2 million, and an increase of research and development cost by $0.2 million.

Net loss for the nine-month period ended September 30, 2015 amounted to $2.2 million, or ($0.06) per share, compared to a net loss of $(1.2) million or ($0.03) per share, for the same period in 2014. This increase of $1.0 million in net loss compared to 2014 is related to the lower gross margin of $(2.0) million offset partly by a better control of selling and administrative cost ($0.8 million) combined with a higher foreign exchange gain ($0.2 million).

Selling and administrative expenses decreased by $0.1 million to $1.4 million in the third quarter of 2015, representing a reduction of 5.5 per cent. The decrease is mainly explained by a reduction of expenses in salaries, professional fees, IT and advertising.

For the nine-month period ended September 30, 2015, the selling and administrative expenses were $3.7 million, compared to $4.5 million for the same period last year. The decrease is mainly explained by the implementation of cost control measures such as reduction of salaries, travel and IT cost for $0.7 million.

As of September 30, 2015, the company had $3.5 million of cash on hand, $0.4 million of bank loan and $4.2 million of long-term debt outstanding, of which $0.2 million is due within one year.

Resignation of Chief Financial Officer

Xebec also announced today that Alnoor Mandjee, (CPA, CA) has tendered his resignation as Chief Financial Officer and Corporate Secretary of the company for personal reasons, effective Nov. 13, 2015. The Company would like to thank Mr. Mandjee for his contribution and wish him the best in the future. Xebec has initiated a search to fill his position.

2015 Third Quarter Financial Statements and Management’s Discussion and Analysis

The complete financial statements, notes to financial statements and Management’s Discussion and Analysis for the nine and three-month periods ended September 30, 2015, are available on the Company’s Website at www.xebecinc.com or on the SEDAR Website at www.sedar.com.

About Xebec Adsorption Inc.

Xebec Adsorption Inc. is a global provider of clean energy solutions to corporations and governments looking to reduce their carbon footprints. With more than 1,500 customers worldwide, Xebec designs, engineers and manufactures innovative products that transform raw gases into marketable sources of clean energy. Xebec’s strategy is focused on establishing leadership positions in markets where demand for gas purification, natural gas dehydration, and filtration is growing. Headquartered in Montreal (QC), Xebec is a global company with two manufacturing facilities in Montreal and Shanghai, as well as a sales office in Houston Texas (USA) and distribution network in North America and Asia. Xebec trades on the TSX Venture Exchange under the symbol XBC. For additional information on the company and its products and services, please visit the Xebec web site at www.xebecinc.com.

Caution concerning forward-looking statements

Certain statements in this press release may constitute “forward-looking” statements within the meaning of applicable securities laws. This forward looking information includes, but is not limited to, the expectations and/or claims of management of Xebec with respect to information regarding the business, operations and financial condition of Xebec. Forward-looking information contained in this press release involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Xebec or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. This list is not exhaustive of the factors that may affect forward-looking information contained in this press release. When used in this press release, such statements use such words as “anticipate”, “believe”, “plan”, “estimate”, “expect”, “intend”, “may”, “will” and other similar terminology. These statements reflect current expectations regarding future events and operating performance and speak only as of the date of this presentation. Forward-looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements.

Source: Xebec Adsorption Inc.

Print this page