WPAC updates on spot prices and Canadian exports

February 21, 2017

By Wood Pellet Association of Canada

Feb. 21, 2017 - In the European industrial market, spot prices have firmed recently. According to Feb. 15 Argus Biomass Markets report, the FOB Baltic spot price was €101/t and the CIF ARA spot price was US$117/t.

In European heating markets, demand has increased in recent weeks due to colder weather, putting pressure on pellet stocks. Rising oil prices have also contributed as in most of Europe, heating oil is once again more expensive than wood pellets. Supply for immediate delivery has been tight in Europe. The residential heating season is nearing its end, easing near-term demand for EN plus grade pellets, which was pressuring industrial grade pellet availability.

According to the Feb. 15 Argus Biomass Report, the price of bagged pellets delivered into northern Italy was assessed at €200-225/t. Deliveries into southern Italy continued to demand a €5-7/t premium to northern deliveries. The price for bulk pellets delivered into northern Italy held steady at €145-155/t.

Germany became a net importer of pellets for the first time in 2016. Production levels were just 1.9Mt while heating pellet demand is estimated to have increased to around 2.1Mt.

In South Korea, state-controlled utility Korea East-West Power (EWP) closed a tender seeking 60,000t of woody biomass solid recovered fuel. Around 15 bidders participated, mostly from Vietnam, with some interest from China, Russia and southern Thailand. EWP’s tender was issued in an attempt to lower prices from its previous tender in January, which was said to have been cancelled because suppliers were offering above its $115/t target on a delivery duty paid basis.

A tender by South Korean independent utility Gunjang closed two weeks ago but the results are yet to be disclosed. Bids are expected to be higher than the utility’s target price of below $110/t.

Korean Western Power issued a tender seeking 45,000t of the material last month for February-May delivery but later only awarded 16,000t because prices offered by suppliers exceeded the amount it was willing to pay. The tender went to three bidders at between $122/t-$125/t ddp.

In Japan, pellet producers are expecting the announcement of new Japanese wood pellet tenders in the coming weeks but delivery dates are unknown. It is expected that Canadian producers will soak up a lot of the demand.

According to the January Forest Energy Monitor, heating wood pellets in Maine were $US288 per tonne and 291 in New Hampshire.

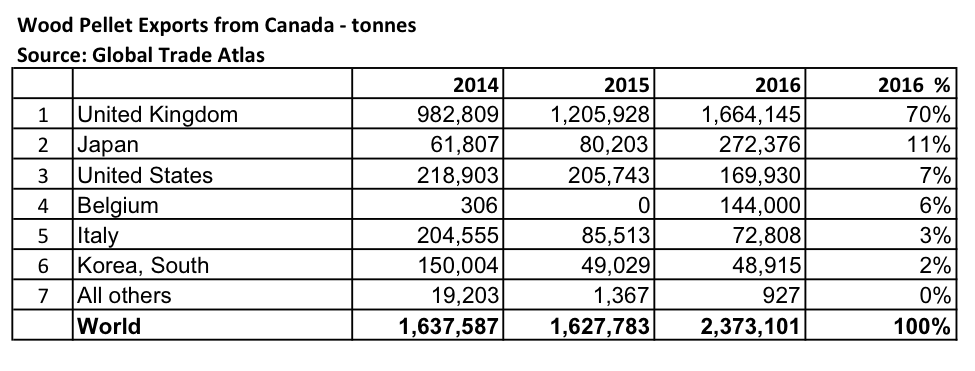

Canadian Wood Pellet Exports 2016

Official export figures are finally available for Canadian wood pellet exports for 2016. Total exports of 2,373,101 tonnes are up by 46 per cent from 2015’s figure of 1,627,783 tonnes. The biggest single increase was to the UK where the year over year increase was 458,217 tonnes. In second place, exports to Japan increased by 192,173 tonnes. Although the total increase was less than for the UK, on a percentage basis, exports to Japan increased by a whopping 239 per cent!

SBP Stakeholder Meeting, January 25

Gordon Murray, executive director of the Wood Pellet Association of Canada (WPAC), attended a meeting of the stakeholder committee of the Sustainable Biomass Program (SBP) in Copenhagen on Jan. 25. Despite a long agenda, the contentious topic of SBP’s governance dominated the first third of the meeting. On behalf of WPAC, Murray repeated his members’ concerns that the utilities have 100 per cent control over SBP, and given the significant interest/stake producers have in the future of SBP, repeated his request that the Board’s composition be extended to include producer representation as soon as possible. At the moment, SBP has the appearance of a buyer’s cartel. Murray advised the SC that he, along with representatives of USIPA and AEBIOM had attended SBP’s December board meeting as a guest. During the meeting, one of SBP’s directors said to the association representatives, “If you don’t like it, you don’t have to sell to us.”

Further, Murray reported that there was a perception that, in North America, the utilities with ownership of production facilities had “jumped to the front of the line” when it came to certification decisions.

Didzis Palejs, President of AEBIOM agreed with Murray, citing that problems with SBP stemmed from its membership which is restricted to power utilities only. He said that the system would never work under the current membership arrangements and that it was unacceptable.

During the stakeholder meeting, utility representatives told the SC that in their view, SBP was a relatively new system, a lot had been achieved and a good foundation had been laid. They said that there was no link between SBP’s structure and the impossibly slow pace of certification approvals.

SBP’s CEO Carsten Huljus told the SC that he is researching a proposal for future governance arrangements for SBP and SBP’s board intends to move towards a multi-stakeholder organization. He promised to have a draft proposal ready in March/April.

Murray asked Huljus to reinforce with the SBP’s board that governance is of high concern for producers.

Jennifer Jenkins of US producer Enviva, reported that both SBP and Accreditation Services International continue to exceed SBP’s stated timelines for the certification report review procedure, and questioned whether ASI was taking on sufficient resources to address the time taken to review the reports.

Now, SBP is proposing to introduce a new requirement for certification bodies to have their reports peer reviewed. This extra step is sure to add to the already unreasonably long time required for applicants (other than utility-owned power plants) to obtain SBP certification. As it is now, Canadian producers who have applied for SBP certification as long as one and a half years ago still have no idea when they will receive a decision regarding certification. In fact, some Canadian applicants will soon be coming up on their second annual surveillance audits without ever having received a certification decision from SBP.

European Commission: Revised Renewable Energy Directive

On Nov. 30, the European Commission (EC) proposed a revised Renewable Energy Directive (REDD II) that identified six key areas for action:

Creating an enabling framework for further deployment of renewables in the Electricity Sector; Mainstreaming renewables in the Heating and Cooling Sector; Decarbonising and diversifying the Transport Sector; Empowering and informing consumers; Strengthening the EU sustainability criteria for bioenergy; Making sure the EU level binding target is achieved on time and in a cost effective way.

RED ll is a recast of the existing 2010/2020 RED prepared by the EC to cover the period 2020-2030. The EC proposed RED ll for joint legislative consideration by the European Parliament (elected MEPs) and the European Council of Member States, in consultation with the EC. This public policy development process will involve significant stakeholder advocacy on proposed amendments, running throughout 2017 and into at least the first half of 2018, with the final enabling Act ready for adoption by 2019.

Among a range of new measures, RED ll establishes sustainability criteria and Greenhouse Gas (GHG) emissions saving requirements for all biomass used in large-scale energy generation across all European Union Member States (MS), including new criteria for forests and wood industry sources, and provides guidance on compliance verification, including voluntary forest certification schemes. This new policy will directly impact Canadian wood pellet producers.

Of most interest to pellet producers will be the new sustainability criteria, which for the first time apply to solid, as well as liquid biofuels. Formerly, sustainability criteria for solid biofuels were left to the EU member states to decide.

Key features of the new criteria for forest biomass are:

- Two options to prove sustainability:

- At the national/sub-national level: forest laws, monitoring and enforcement in place with these features: (1) harvest accorded to a legal permit, including gazetted boundaries; (2) forest regeneration post-harvest; (3) high conservation value areas, wetlands and peatlands are protected; (3) soil quality and biodiversity impacts are minimized; and (5) harvesting does not exceed long-term forest production capacity;

- At the forest holding level: same evidence is required but can be provided through forest management systems, including via voluntary national or international forest certification schemes that have been EC assessed and approved.

- Land use, land-use change and forestry (LULUCF) emissions are to be measured and accounted for at the production country level: with two proof options:

- At the country level: Country is a Party to and has ratified the Paris Agreement; submitted a Nationally Determined Contribution (NDC) including reducing LULUCF emissions and the conservation and enhancement of carbon stocks and sinks based on national inventories, accounting and reporting procedures that meet UNFCCC and Paris Agreement decisions (note: this will be a problem for the USA if it withdraws from the Paris agreement as President Trump has threatened);

- At the forest holding level: evidence through management systems to ensure forest carbon stocks and sinks are maintained.

- Sustainable Forest Management Principles & Risk-based approach: the RED ll recital paragraph 76 states that forest harvesting which generates biomass for energy needs to be in accordance with principles of sustainable forest management that have been developed internationally, including Forest Europe. To minimize forest biomass sourcing risks, operators (i.e. the power generator) should put in place risk-based approaches, for which the EC will develop operational guidance on compliance verification.

- EU member states may place additional sustainability requirements for biomass fuels over and above the RED ll requirements.

There is a lot to digest with the EC’s new proposals, and it is impossible to predict what changes will come about as they work their way through the European Parliament and the European Council. WPAC will continue to co-ordinate policy experts at the European Biomass Association as this situation develops.

Print this page