2022 wood pellet markets outlook

January 25, 2022

By William Strauss

A look at the pellet export markets in 2022 and beyond

Photo: Annex Business Media.

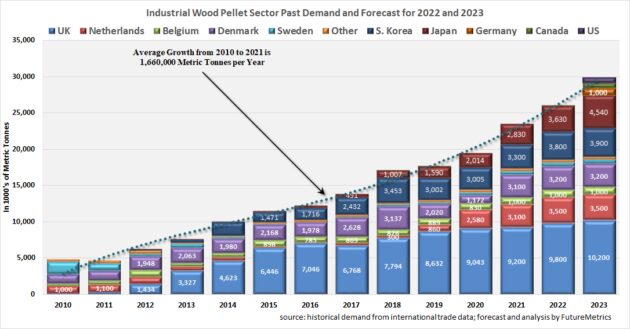

Photo: Annex Business Media. The industrial wood pellet markets have been growing at an annualized rate of about 1.66 million metric tonnes per year from 2010 through 2021.

As the consequences of climate change become increasingly obvious and costlier as a result of more frequent and more severe events globally, the pace of decarbonization will accelerate. Wind and solar power, coupled with massive energy storage solutions, will become the foundation of power generation in many jurisdictions. But it will be at least a decade, and probably much longer, before grid-level energy storage coupled with wind and solar generation, and perhaps the build out of new nuclear generation capacity, is sufficient to allow most traditional thermal generation from coal and natural gas to be eliminated.

There is a well-proven strategy that can bridge this gap. That transition strategy is already a mainstay in some jurisdictions. The strategy is based on the substitution of coal for sustainably sourced pellet fuel in existing coal-fueled generating stations. Between now and a future that is primarily dependent on wind and solar generation, as well as massive energy storage able to keep electricity flowing at all times, this well-proven and already deployed strategy will be an important component in how nations decarbonize their power sectors.

Asia and Europe, already significant users of pellet fuel, will continue to use significant quantities. It is likely that other European nations that are seeking a way to lower the CO2 emissions from coal generation will follow. Furthermore, other regions, such as Canada and the U.S., will likely promulgate policies that support this rational, pragmatic, and ready-to-use strategy.

As is shown below, if policies evolve in response to the increasing severity, frequency, and cost of climate change-induced events, those policies, if rational and pragmatic, will lead to higher demand for pellet fuel.

The supply capacity of the pellet fuel sector in not unlimited. It is defined by the limits of working forests for supplying sustainable feedstock to the pellet mills. As is discussed in several FutureMetrics white papers, the limits to growth in the pellet fuel sector are based on the constraint that the managed working forests, which supply wood to the users of forest products, cannot be depleted. The primary users of forest products are the producers of building materials, paper, packaging, and tissue. Pellet producers use the by-products from those industries and logs that are unsuitable for them.

Current policies that support the substitution of coal for pellets already impose strict standards and rigorous third-party auditing that ensures the carbon stock in the working forests is not being depleted. Future policy must do the same.

There is room for significant growth in the wood pellet industry, but there are limits. In other words, the use of pellet fuel in coal stations can only be a part of a much broader power sector decarbonization strategy.

So, what will this mean for the wood pellet export markets in 2022 and beyond, particularly in Canada? The rest of this article looks to provide some insights on this topic.

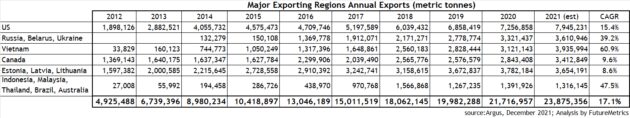

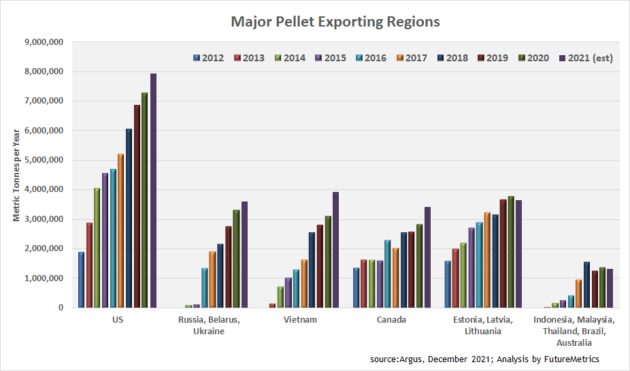

Table 1 and Figure 1 show the exports from the major pellet exporting regions.

FutureMetrics expects demand to increase by 8.9 per cent from 2021 to 2022 and by another 14.8 per cent from 2022 to 2023. In 2023, FutureMetrics expects modest new demand in the U.S. and Canada as decarbonization policies evolve. Japan and Germany are expected to add about one million tonnes per year of demand in 2023.

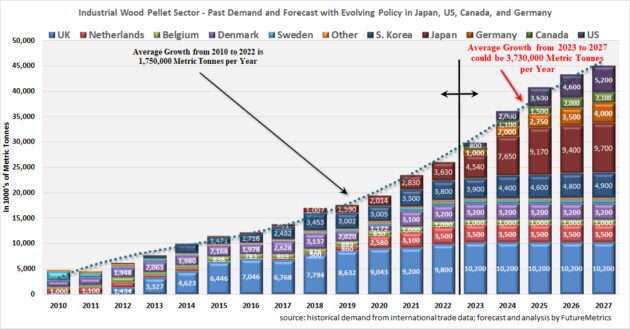

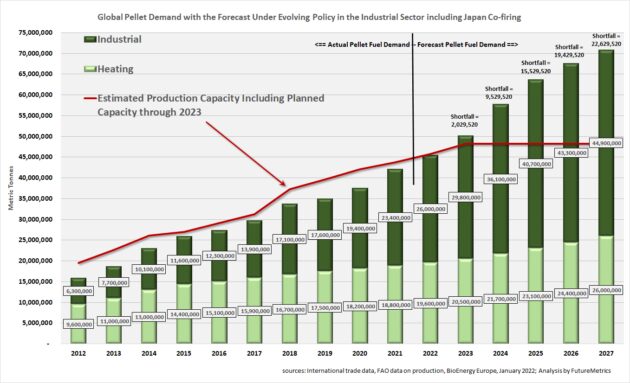

However, under a scenario in which U.S., German, and Japanese policy evolves over the next five years, demand for pellet fuel could grow at an annualized rate of 3.73 million metric tonnes per year. Figure 3 shows this scenario.

As FutureMetrics has discussed in its white papers (free to download from the FutureMetrics website), given the increasing frequency and severity of climate change-induced events, and given current policies for decarbonization in Japan and Germany, this is a plausible scenario if policymakers and the general public can be educated on the efficacy of substituting coal for pellet fuel and motivated to promulgate supporting policies.

Figure 4 shows the historical and forecast of combined heating and industrial pellet demand. The red line in Figure 4 shows the estimated production capacity, including all of the announced new planned capacity over the next two years. As the chart shows, if policy evolves and pellet fuel demand follows the growth shown in Figure 3, there will be significant supply shortfalls going forward.

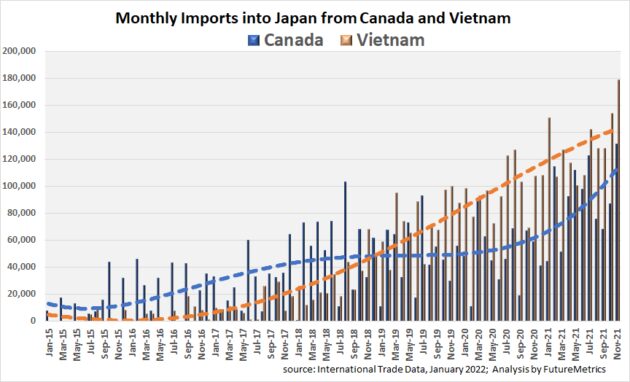

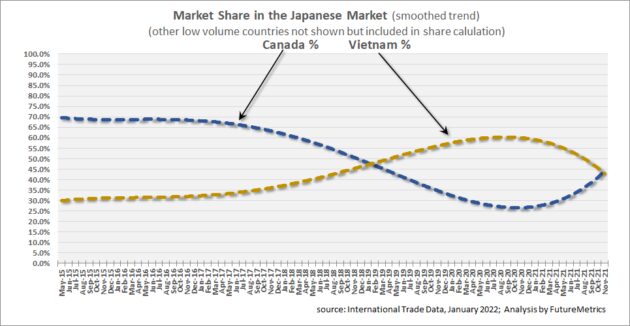

This is good news for all of the major pellet producing regions and, given how demand for pellet fuel is expected to grow in the Japanese and Canadian power sector, for Canadian pellet producers. Western Canadian pellet producers have already established a strong presence in the rapidly growing Japanese market. As Figures 5 and 6 show, Canada is on the brink of reclaiming it leadership in Japanese market share for imported pellet fuel.

As long-term offtake agreements between Canadian producers and Japanese buyers ripen, Canada’s market share will increase. After Japan finalizes its sustainability and greenhouse gas (GHG) emissions criteria for imported biomass (probably before the end of 2022), it is likely that some Vietnamese producers will be challenged on the sustainability of their feedstock. It is also likely that some palm kernel shell (PKS) imports will be challenged on issues related to palm oil production (for example, land use change and child labour). Longer shipping distance on smaller vessels may also promote a carbon footprint disadvantage. These influences will benefit pellet producers with strong sustainability credentials and optimal supply chain carbon footprints.

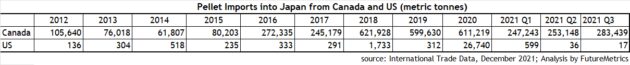

In 2021, the large U.S. pellet producer, Enviva, publicly announced offtake agreements into Japan in the millions of tonnes per year. Once those contracts ramp up, the U.S. will join Canada and Vietnam as major suppliers to Japan. To date, however, the U.S. has not been a significant supplier, as Table 2 shows.

There is a likelihood for significant new pellet fuel production capacity to be developed over the remainder of this decade. Canadian producers with competitive fibre costs, globally respected sustainability credentials, and the potential for optimal GHG footprints from both the west and east coasts are well-positioned to be part of the supply build up.

William Strauss, Ph.D., is the president of FutureMetrics, www.futuremetrics.com.

Print this page