Biomass Torrefaction Technologies

August 22, 2011

By Treena Hein

Torrefaction makes sense in many ways, and the bioenergy sector is taking notice.

|

| A number of companies are testing various methods of woody biomass torrefaction, with the goal of producing densified “black” pellets or briquettes. Torrefaction and densification result in greater energy content per unit volume and mass, water resistance, and friability, allowing the material to be handled similarly to coal at large-scale power generation facilities.

|

Torrefaction makes sense in many ways, and the bioenergy sector is taking notice. It’s a controlled carbonization process in which biomass is heated with little or no oxygen at high temperatures to produce a black char-like substance. The usual process involves raw wood or other biomass being prepared and torrefied, and then pelletized or briquetted (see sidebar on page 13). Lab data suggest that torrefied wood is irreversibly hydrophobic, which means it can be stored and handled outdoors, and it is also believed to be up to 40% more energy dense than non-torrefied biomass, i.e., having more energy per unit of mass. Both of these qualities reduce storage and transportation costs in comparison to regular wood pellets

or briquettes.

Torrefied material is also relatively immune to rotting. It is more easily crushed than other feedstocks and contains higher concentrations of lignin, which means some torrefied material apparently is compressible without any additives. Torrefied material also behaves like coal, so little new infrastructure is needed to co-fire torrefied pellets or briquettes with coal—and that’s where the biggest market potential lies. Thermya, an engineering firm in France that specializes in producing carbon products from organic materials, states that in tests, its “Torspyd BioCoal ignites earlier than coal, which helps to catalyze the combustion, reduces the ash content, and improves the boiler’s overall energy performance.”

|

|

“In recent years, torrefaction has generated significant interest around the world, fuelled not only by the technology developers, but also by pellet producers and end-users such as power utilities and cement and steel industries,” says Sebnem Madrali, acting manager for biomass combustion at CanmetENERGY, the science and technology arm of the Innovation in Energy Technology Sector of Natural Resources Canada. Through its involvements with various scientifically driven initiatives, CanmetENERGY’s objective for torrefaction is to better understand the role it could play in the production and use of advanced solid biofuel in various Canadian sectors. “The market potential for the torrefied material is believed to be broad and significant,” she notes. “The global torrefaction landscape encompasses entities from universities to research institutes to companies small and large, with technologies at various stages of research, development, and commercialization.”

Studying the Challenges

For all its benefits, torrefaction is an extra step to feedstock preparation that takes energy and therefore money. In addition, the particular conditions used for the process can result in differing end-product quality.

“Inconsistency in feedstock particle size and moisture content is a concern because variations in heat transfer result in uneven carbonization,” notes Madrali. The smallest pieces will turn to charcoal whereas the larger pieces will not be fully torrefied. Small particles are also a limitation for some torrefaction technologies because they can cause clogging and obstruction of gas flow.

|

|

| BC-based Diacarbon recently commissioned a demo plant with 1.3-tonne/hour processing capacity using its own technology and is currently testing various feedstocks.

|

“Control of the reactor is also a challenge in terms of getting the right dynamic time and temperature strategy to deal with moisture, particle size, and volatile content,” Madrali explains. “Fouling in the reactor vessel needs to be avoided. Within the gas loop, there can be inefficient use of volatile calorific content and fouling of ductwork.” She adds that in densifying torrefied materials, high feedstock temperature and the highly reactive dust can also present a risk of explosions and fires.

NORAM Engineering and Constructors Ltd. of Vancouver recently completed a study examining how torrefaction could be incorporated into a pellet manufacturing facility to improve the product and reduce shipping costs. The study was commissioned by the Wood Pellet Association of Canada, Natural Resources Canada, and the BC Bioenergy Network. “[Doing this] is feasible,” says NORAM’s Jim Wearing, “and several suppliers offer proven technology able to meet these specific needs. However, there are several key technical factors which must be accommodated, including avoidance of condensation of natural wood extractives in the gas loop, and handling of sawmill residuals [with] a wide particle-size distribution.” He adds, “At this point, the market is unclear on the specifications for torrefied material, for example, the degree of torrefaction required.”

During conversations with pellet manufacturers and torrefaction technology suppliers, Wearing says he learned that in standard pellet mills, die life could be shortened when using torrefied material because it is harder than untreated wood. So although binders do not appear to be needed for pellet manufacturing at lower temperatures, they could be valuable for die lubrication.

|

|

| Studies are ongoing for safety during torrefied pellet handling.

|

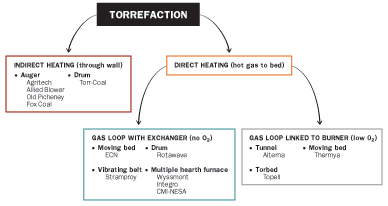

Technology Types

Torrefaction technology falls into two main categories: indirectly and directly heated. Torrefaction with indirect heating is accomplished using an auger or a drum. The direct heating torrefaction method can involve a non-oxygen gas loop with exchanger using a moving bed, drum, vibrating belt, or multiple hearth furnace; or it can involve a low-oxygen gas loop linked to a burner using a tunnel, moving bed, or a “Torbed” (see graphic on page 15). Of these eight types of technology, only a few are producing more than five tonnes/hour of material, says Madrali. She concludes, “There is a diverse range of torrefaction technologies that are of distinct and sound design. It is also important to note that torrefaction is only one component of an overall process scheme. Other process components such as feedstock preparation, process controllability, and integration of the gas loop are as important.”

The Montreal-based Centre for Energy Advancement through Technological Innovation, or CEATI International Inc., is currently coordinating the evaluation of torrefaction and other technologies on behalf of several major utilities from Canada, the United States, and Europe, as well as Canadian government agencies. “We’ve selected a wide range of fuels using different types of torrefaction technology, which should give us a comprehensive set of data,” says David Lapointe, manager of CEATI’s generation and use program. He says at this point, it is premature to establish a technology leader, but they will have a better understanding when commercial-scale tests are occurring, around mid-2012.

|

|

| Spruce-pine-fir samples were torrefied at various temperatures and pelletized at the University of British Columbia for the NORAM study.

|

Torrefaction Projects in Europe

Because co-firing of wood pellets and coal is big in Europe, utilities have shown great interest in torrefied material due to its coal-like storage and handling properties.

“Here [in Europe], torrefaction provides all the necessary solutions needed for the expanded use of bioenergy,” says Michael Wild, director of the Vienna, Austria-based firm Wild&Partner. “It offers increased cost competitiveness, the possibility of using established technology (i.e., coal-fired generating plants), better storability and transport of product, the development of commodity status, and a broadening of feedstock possibilities.”

Wild says it’s very difficult to quantify European demand for torrefied pellets because they have yet to “really hit the market.” However, he notes that Swedish power-generating giant Vattenfall has openly stated that its need for (preferably torrefied) pellets will be 20 million tonnes by 2020, and “given this, it is easy to expect a number of 50 million tonnes or more as European demand by 2020.”

ACB consortium (a group that includes Wild&Partner, Andritz AG, and Polytechnik) is building a demonstration plant near Graz, Austria, that will produce one tonne/hour of torrefied material from wood from nearby forests by August 2011. “The size of the plant was set quite small in order to have the installation available for test runs of all kind of feedstock in the future,” says Wild. He adds that in fall 2011, Andritz will be the first company to offer full-scale turnkey ACB plants of 50,000 tonne/year capacity, including driers, torrefaction, heat supply, coolers, densification, and installation.

In Belgium, 4Energy Invest has completed a directly heated vibrating belt (Stramproy) system producing 5.5 tonnes/hour, and Torr-Coal is running an indirectly heated drum system at 4.5 tonnes/hour. In the Netherlands, Stramproy Green has a directly heated vibrating belt system producing 5.5 tonnes/hour, and Fox Coal has an indirectly heated auger system finished for 4.2 tonnes/hour, with a similar 12 tonne/hour project being built for the end of 2011. Also in the Netherlands, Topell Nederland (a joint venture between Topell Energy and RWE Innogy) has finished construction of a directly heated Torbed system of eight tonnes/hour. That plant will produce at least 60,000 tonnes/year of fuel, which will be used to produce electricity at the Essent power plant in Geertruidenberg, the Netherlands, for around 42,000 households.

Atmosclear has finished an airless system in Latvia of about five tonnes/hour. By the end of 2011, IDEMA will complete a Thermya Torspyd (directly heated moving bed) system in Spain that will produce 2.5 tonnes/hour. Two other Torspyd units are expected to be completed in fall 2011 in France, each producing 20,000 tonnes/year of biocoal. ECN (Energy Research Centre of the Netherlands) started working on a demonstration project with Vattenfall in mid-2010 that is expected to start in 2011.

|

| The main types of torrefaction technology under development today, with their associated companies. Adapted from NORAM and the Wood Pellet Association of Canada

|

| 10 Phases of Torrefied Pellet Production

Pre-torrefaction Torrefaction Post-torrefaction Adapted from the |

Canadian Torrefaction

Canada supplies the majority of its wood pellets overseas, so there is high interest in torrefaction here. The Wood Pellet Association of Canada (WPAC) is researching a number of projects using its own funding, supplemented by private and government investments. “We’ve done advanced kinetic modeling at University of British Columbia from 2006 to 2010 and are developing a demonstration project at five tonnes/hour,” says WPAC executive director Gordon Murray.

In Newcastle, New Brunswick, a torrefaction project involving Vatenfall, Miramichi Premium Pellet, and others has been proposed to the province, and the application is still being evaluated.

Torrefuels, in Ottawa, recently completed laboratory-scale proof-of-concept runs. “Currently, we are working through the design and engineering work in order to begin the process validation at 50 kilograms/hour and scaling into five tonnes/hour, which is scheduled to commission in late 2012,” says CEO Anjali Varma. The scalable system will be able to handle multiple feedstocks. Torrefuels intends to build a one- to five-tonne/hour facility in Portage du Fort, Quebec, at the existing Trebio pellet facility. “Raw materials are going to be sourced by our partner Trebio, who has an existing arrangement for local fibre supply,” Varma explains. The company is looking at briquetting because “torrefied briquettes can be used just like coal briquettes and they require less energy to manufacture than pellets,” Varma notes, but it is also looking at pellets “depending on future demand.”

|

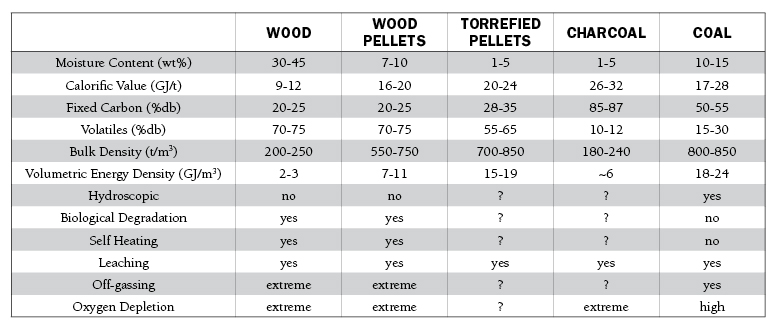

| Comparison of torrefied pellets and other fuels. Source: CanmetENERGY Natural Resources Canada

|

Airex Energy in Montreal has built a rapid torrefaction unit with its patented CarbonFX technology. President Guy Prud’homme says this proof-of-concept unit produces 0.25 tonnes/hour. As a next step, Airex is connecting with Colacem Canada Inc., through support from the Agence de l’efficacité énergétique, Quebec’s Energy Efficiency Agency. Colacem’s cement plant in Grenville-sur-la-Rouge, Quebec, will fire Airex torrefied biocoal with conventional coal, and tests will be conducted by FPInnovations. Airex is also developing a five tonne/hour pilot project in partnership with a large pulp and paper company that will produce over 40,000 tonnes/year of torrefied pellets, expected to be operational later in 2011 or in 2012.

Allied Blower, in Surrey, British Columbia, supplies material handling systems to wood pellet plants and became interested in torrefaction as a solution for problems with wood pellets, such as moisture issues, says principal sales representative Erkki Rautiainen. The company developed an indirectly heated torrefaction process using existing drying technologies. When used in an integrated energy plant, it will combust torrefaction gases to create heat for the drying process. The company is searching for a partner to work towards proof-of-concept development of the technology.

Diacarbon, in Burnaby, British Columbia, has just commissioned a demonstration plant with a 1.3-tonne/hour processing capacity using its own technology and is currently testing various feedstocks. It can currently produce about 10 tonnes/day from sawmill residue (and perhaps clean construction and demolition waste in future). The company is now planning a 2.5-times scale-up plant, says president Jerry Ericsson. “We are investigating both pellet and briquette technology to compact the torrefied wood produced by our system,” he says. “Our target market is domestic, small-scale industrial energy consumers.” Ericsson says the current demand for pellets in Canada is small compared to the huge demand in European markets. “However, there is great interest [here] for use as a coal substitute in several boiler applications,” he says. “There is an increase in demand for wood pellets in British Columbia and Canada, and it is expected that when the availability of torrefied material increases, a domestic market will emerge.”

“Canada, and British Columbia especially, has excellent raw material resources and a strong know-how in selling wood pellets,” concludes Rautiainen. “By investing properly in process development, Canada can also be the leader in supplying torrefied biocoal to the world market searching for green alternatives.”

Print this page