Drax releases trading update

November 27, 2015

By Drax

November 27, 2015 - Drax recently published a trading update for the period from July 1 2015 to date.

The company stated trading conditions in the markets in which it operates have remained challenging, with further weakness in power prices. However, the company continues to benefit from good operational performance and, since July, have strengthened its 2015 and 2016 hedges for power sales at prices significantly above the current market.

Biomass operations at Drax continue in line with expectations. Its first major planned biomass unit outage was completed over the summer, with no biomass related issues identified. The unit is now back in full operation.

In addition to the existing U.K. east coast port facilities, it has added further import capability with new facilities at Liverpool.

Power sales contracted for 2015 and 2016

Draw has extended its contracted position, including additional power sales of 1.4TWh and 4.5TWh for 2015 and 2016 respectively, compared to the position reported in July.

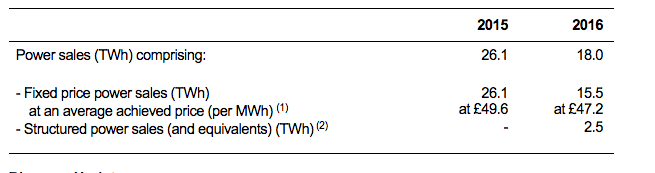

As of Nov. 16, 2015, the power sales contracted for 2015 and 2016 were as follows:

State aid

The Investment Contract(3) for the third biomass unit conversion remains subject to EU State aid clearance.

Other matters

Draw will announce its full year results for the 12 months ending Dec. 31, 2015 on Feb. 23, 2016.

~~~~~~~~~~~~~~~~~~~~~~~

Notes:

(1) Fixed price power sales include approximately 2.0TWh supplied to Centrica in the period 1 January 2015 to 27 September 2015 under the five year 300MW baseload contract which commenced on 1 October 2010. Under this contract the Group supplied power on terms which included Centrica paying for coal, based on international coal prices, and delivering matching CO2 emissions allowances amounting in aggregate to approximately 1.8 million tonnes in 2015. The contract provided the Group with a series of fixed dark green spreads agreed in October 2009.

(2) Structured power sales (and equivalents) include forward gas sales, providing additional liquidity for forward sales, highly correlated to the power market and acting as a substitute for forward power sales.

(3) The Government introduced Contracts for Difference (CfDs), which are long-term contracts, to support the development of low carbon electricity generation. To avoid an investment hiatus in the renewables sector before CfDs become available under the enduring regime, the Government introduced a scheme for Investment Contracts under the Final Investment Decision Enabling (“FID Enabling”) for Renewables mechanism. These were ‘early’ CfDs intended to provide greater confidence for investors in advance of the enduring CfD.

Source: Drax

Print this page