Update on global forest industry markets

August 22, 2011

By Hakan Ekstrom | Wood Resources International

Aug. 22, 2011 – Wood Resources International provides an overview of recent and long-term activity in forest industry markets.

Global timber markets

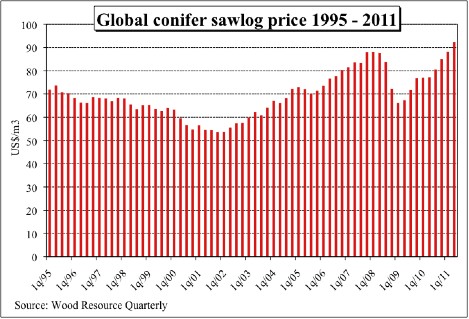

The Global Conifer Sawlog Price Index

(GSPI) reached a new all-time high of US$92.27/m3 in the second quarter of 2011

(see graph). This was 5.6% more than the previous quarter, and an almost 20%

jump from one year ago. The GSPI has gone up every quarter since the first

quarter of 2009, when the Index was at $66.10/m3. This almost 40% increase in

two years is due not only to the weakening of the U.S. dollar against all other

currencies in the Index, but also to the higher costs of logs in local

currencies.

|

Global pulpwood prices

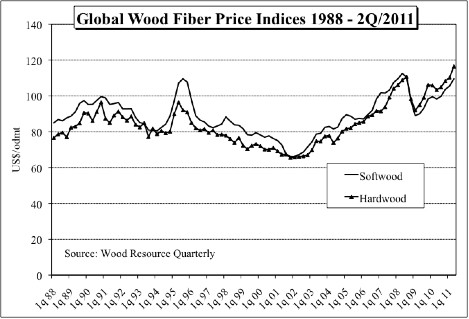

Wood fibre costs for the global pulp

industry have trended upward for over two years. The Softwood Fibre Price Index

(SFPI) reached $109.52/oven-dry tonne (odt) in the second quarter of 2011, a

3.7% increase from the previous quarter and a 23% increase from Global Wood

Fibre Price Indices two years ago. In local currencies, fibre prices increased

the most in the U.S. Northwest, western Canada, Russia, and Finland. The

weakening U.S. dollar against most global currencies resulted in higher fibre

prices in all regions covered by the Wood Resource Quarterly in U.S. dollar terms.

The Hardwood Fibre Price Index (HFPI)

reached a new all-time high in the second quarter of 2011 at $116.44/odt, which

was 5.5% higher than the in the first quarter of 2011 and almost 27% higher

than in early 2009. Recently, hardwood prices have increased the most in

Indonesia, Finland, Russia, and Brazil.

|

Global pulp markets

Global pulp markets continued to be

surprisingly strong in the second quarter of 2011, setting record high prices

for most market pulp grades. The NBSK pulp prices ranged between $1010/ton and

$1040/ton, both in Europe and in North America, while prices in China were

around $850-930/ton. Global production of market pulp was up as much as 8%

during the first five months of 2011 compared to 2010. The highest increase

occurred in Latin America; the gain in Europe was somewhat smaller.

Global lumber markets

Lumber exports from the Nordic countries

slowed during spring, and prices fell slightly. The average export prices of

lumber from Finland and Sweden have fallen from fall 2010 and were 3-6% lower

in April 2011 than in October 2010. Lumber production in the United States fell

by 13% from March to April because of slowing domestic demand, and the average

operating rate for U.S. sawmills was down to 67%.

With the persistent weak demand for lumber

in the United States, sawmills in eastern Canada continue to struggle, as they

are very dependent on the health of the U.S. market for their survival. The

operating rate so far in 2011 has been only 55% of capacity.

Lumber imports to China continue to set new

records. During the first five months of 2011, the importation of softwood lumber

was up 72% from the same period in 2010.

Global biomass markets

Prices for woody biomass, including mill

and forest residues, increased slightly in all major biomass-consuming regions

of the U.S. in the second quarter of 2011.

Pellet prices in Europe were unchanged or

slightly lower in the second quarter of 2011 as compared to the first quarter,

but the long-term trends are still upward, with prices being close to record

levels.

Asian demand for biomass energy is finally

beginning to emerge. Japan, China, and South Korea have recently announced

policies to increase the use of biomass.

Print this page