Global Pellet Demand Rises

March 29, 2012

By Todd Bush Silvio Mergner and Hannes Lechner

In the next eight years, significant growth is predicted in wood fuel pellet markets worldwide.

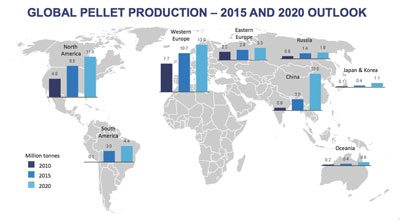

In the next eight years, significant growth is predicted in wood fuel pellet markets worldwide. Europe will continue as the largest source of demand, with markets also emerging in Asia. Growth in production will continue in North America, but new production is being established in nearly all wood fibre baskets worldwide.

|

|

| Pellet machines will be growing in number throughout North America thanks to significant increases in demand.

|

In addition, pellets produced from agricultural products and through innovative processes such as torrefaction may also emerge to some degree. The fact is that no region or technology remains the obvious leader for prudent investment decisions. With growth nearly tripling by 2020, each region and technology has its own unique pros and cons.

As a management-consulting firm, Pöyry has delivered due diligence, pre-feasibility, feasibility and strategy-consulting projects to organizations in every link in the wood bioenergy value chain. In addition, the firm has conducted extensive market research and reviews for the entire pellet industry.

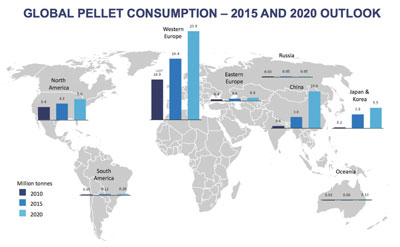

The current global market volume of biomass pellets of around 16 million metric tons annually (mt/a) is projected by Pöyry to increase to 46 million mt/a by 2020, representing a total market value of up to $8 billion U.S. The adoption of biomass fuel pellets is largely driven by policy and financial incentives in much of the world, and this will continue to be the case. However, this reliance on traditionally unpredictable policy incentives adds a level of uncertainty. Increasing influence from fossil fuel prices will also play a larger role in the future.

|

|

| In the next 10 years, look for a doubling of pellet production in North America, and major growth in Europe and China.

|

Western Europe will remain the largest consuming region (13 million mt/a), with much of the growth being driven by the production of electricity in the Benelux countries, Denmark and the U.K. In addition, continued growth is forecast for the residential and commercial heating markets in Scandinavia and other parts of Europe.

Further growth is predicated on a large gap between what is currently used for forestry biomass-based energy generation and what is outlined in each country’s National Renewable Energy Action Plan (NREAP) to come from wood-based biomass (340 TWh), and more specifically on each country’s NREAP goals to come from pellets.

In contrast to Europe, North American growth is predicted to come from the residential heating market, largely driven by the increasing cost of heating oil relative to fuel pellets. Moderate growth is also forecast in the industrial energy market, though this assumes an extremely minor role for government incentives that could otherwise greatly increase adoption.

China has appeared on the radar as a significant future pellet consumer and producer, with the addition of a large number of pellet plants into the project pipeline. Most of the feedstock requirement in the country is forecast to be satisfied through production from domestic agricultural and processing residues such as rice husk, and so this growth is not expected to have a large influence on international trade flows. China alone is expected to account for more than 20% of worldwide demand in 2020, compared to a negligible amount currently. This will put China on the map as a wood pellet market, though it does not interact significantly in intercontinental trade.

|

|

| Fossil fuel costs and government policies and incentives will boost consumption within the next decade, with demand skyrocketing in western Europe and China.

|

Transcontinental trade flows of pellets totaled 2 million mt/a in 2010 (including Eastern to Western Europe), with nearly all of this between North America and Western Europe. Relatively minor amounts also moved from North America to Asia, Canada to the U.S., and Eastern Europe to Western Europe. Pöyry expects all of these current trade flows to increase in magnitude, while movements are expected to emerge from South America and Russia to Western Europe, as well as from Oceania to Japan and Korea. Total transcontinental trade flows in 2020 are expected to reach over 18 million mt/a, or about 40% of total production.

In order to supply this international trade in biomass, increasingly large pellet manufacturing facilities have been built in regions with high biomass availability. The first of these plants were built in Western Canada to take advantage of fibre made available by the mountain pine beetle infestations. Next, plants were built in the southeastern U.S. to utilize roundwood and residues, and in Australia to use existing harvesting residues from eucalyptus plantations. Just recently, the largest plant in the world was completed in Russia, and plants are in varying stages of development in eastern Europe and South America. All these plants are designed to feed the growing demands of western Europe, but are more likely to be destined for northeast Asia in the near future.

Low-cost producers in emerging markets are likely to be very competitive against North American producers that are already seeing tight profit margins. Supply push is likely to come from South American mills that have an advantage in fibre costs, while eastern European producers face much lower transportation expenses to off-take markets. Demand will continue to come from western Europe, but Pöyry expects that it will also emerge from Japan and Korea soon. This demand will be fed primarily from the West Coast of North America and Oceania. Africa may begin to play a role in the European market, but major developments are likely beyond the 2020 time horizon of this study.

The other side of the pellet industry is the residential market. This facet is highly fragmented in most regions. These smaller plants vastly outnumber larger industrial ones, since they often utilize sawmill residues from nearby wood products industries or are integrated directly into a sawmill. Because of the various markets to which these residues can be sold, and fluctuations in wood product demand and sawlog supply, many of these facilities often run at low utilization rates. This was very much the case during the economic downturn of the previous two years, where all wood product manufacturing decreased and fewer residues were available to the market. Couple this to the fact that a significant number of pellet manufacturing facilities focusing on the residential markets came online in 2008 and 2009, it becomes clear that currently this can be a difficult market to be in.

Production conditions and end-use markets for the two different pellet classes differ, as do their prices and respective outlooks. Residential pellet markets are usually rather regional and are expected to remain this way, though prices are expected to increase in Europe (where the greatest number of trades occur). Industrial pellet prices are more reminiscent of commodities, and are therefore less regional. Pöyry predicts that the prices for the latter will remain relatively stable thanks to the large amounts of supply that will come online from new regions, while incentives in Europe will both increase demand and act as a sort of cap on what pellet consumers are able to pay.

The magnitude of growth for this market is heavily dependent on the political will for expanding biomass energy utilization and the associated incentives surrounding it. These incentives are currently especially favourable in countries such as the Netherlands, Denmark, Belgium and the United Kingdom. In addition, demand depends on the cost of alternative energy sources to pellets, which influences the competitiveness of such a fuel. This is especially the case in countries where the bulk of pellet demand is in the residential sector, for example Germany and the United States.

There are some signs that industrial users of pellets are beginning to integrate upstream by building their own pellet mills in areas with high biomass availability, as is the case with RWE/Georgia Biomass and Vattenfall/Miramichi. This step can assure biomass energy producers better control over supply chains, but not supply security.

In addition, many small pellet producers are starting to either downstream integrate to control their distribution or join with other pellet producers to increase their market share, at least regionally. This shows signs of market maturation, though in most markets, biomass pellets have not reached the point of being a commodity due to differing quality standards and a lack of transparency from relatively few trades per unit of time. Producers may struggle to keep costs low in order to maintain their bottom line. It will remain essential to find ways to improve efficiency and increase productivity in an increasingly competitive market.

This article was submitted by Pöyry Management Consulting.

Print this page