Low-risk Trading Environment

August 13, 2012

By Gordon Murray

In May, WPAC president Robert Tarcn and I visited the London offices of CME Group to learn about their new central clearing service for over-the-counter (OTC) wood pellet swaps.

In May, WPAC president Robert Tarcn and I visited the London offices of CME Group to learn about their new central clearing service for over-the-counter (OTC) wood pellet swaps. CME Group is the world’s largest operator of financial derivatives exchanges, which include the Chicago Mercantile Exchange, the Chicago Board of Trade and the New York Mercantile Exchange. CME Group has now entered the world of wood pellets. We met with CME representatives Richard Stevens, Louise Croucher and Lisa Kallal. Brodie Govan of Argus Media also attended.

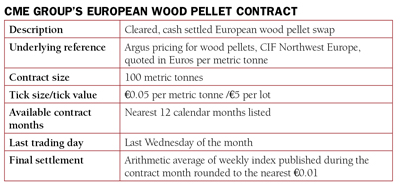

CME Group is now offering central clearing for OTC wood pellet swaps through its subsidiary CME Clearing Europe (CMECE). A swap is a financial derivative in which two parties trade cash flows with one another, but not the actual physical underlying commodity. This is different from what occurs on the APX-ENDEX wood pellet futures exchange where physical product ultimately changes hands.

A clearing house is a financial institution that provides clearing and settlement services for financial and commodities derivatives and securities transactions. These transactions may be executed on a futures exchange or securities exchange, as well as off-exchange in the OTC market as in the case of CMECE’s clearing of wood pellet swaps.

A party who wishes to trade uses the services of a broker who is a member of the clearing house. The clearing house stands between two brokers and its purpose is to reduce the risk of one (or more) broker failing to honour its trade settlement obligations. A clearing house reduces the settlement risks by netting offsetting transactions between multiple counterparties, by requiring margin deposits, by providing independent valuation of trades and collateral, by monitoring the credit worthiness of the broker-members, and by providing a guarantee fund that can be used to cover losses that exceed a defaulting broker’s collateral on deposit.

Once a trade has been executed by two counterparties, the trade can be handed over to a clearing house, which then steps between the two original traders’ brokers and assumes the legal counterparty risk for the trade. As the clearing houses concentrates the risk of settlement failures into itself and is able to isolate the effects of a failure of a market participant, it also needs to be properly managed and well capitalized in order to ensure its survival in the event of a significant adverse event, such as a large clearing firm defaulting or a market crash.

|

So what is a swap? A swap refers to an agreement between two parties to exchange a series of payments on predetermined terms. A commodity swap refers to an agreement between two parties under which the cash flows that need to be exchanged are dependent on the price of the underlying commodity. The underlying commodity can be anything from coal, oil or natural gas to agriculture products, metals, and – in this case – wood pellets. Commodity swaps can be used by a commodity buyer (i.e., a power utility) in order to hedge against the rising prices of commodities, so, for example, if a power utility needs to purchase wood pellets but is concerned about rising wood pellet prices, it can opt for a commodity swap where it agrees to receive payments linked to a pellet price index and pays a fixed rate to the other party in exchange.

Commodity swaps can also be used by the producer of a commodity (i.e., a pellet producer). If a producer is concerned about being protected from falling prices, then the producer can go execute a commodity swap where the producer will agree to pay the market price to a financial institution in return for receiving fixed payments for the commodity.

Wood pellet markets are continuing to grow rapidly. Price volatility is expected to increase. Wood pellet swaps may prove to be a useful tool for both producers and consumers to reduce price risk. Certainly CME Group’s new clearing service will be essential for such OTC swaps to take place in a stable low-risk trading environment.

Gordon Murray is executive director of the Wood Pellet Association of Canada. He encourages all those who want to support and benefit from the growth of the Canadian wood pellet industry to join. Gordon welcomes all comments and can be contacted by telephone at 250-837-8821 or by e-mail at gord@pellet.org.

Print this page