Pellet Export Strategies

October 31, 2011

By

Heather Hager

Market consultants expect the global wood pellet industry to triple over the next ten years as renewable energy gains in importance.

Market consultants expect the global wood pellet industry to triple over the next ten years as renewable energy gains in importance. That potential is already attracting new players to pellet manufacturing, both within and outside North America. To discuss strategies and challenges for moving their wood pellets in the growing global industrial market, North American pellet exporters met in New Orleans in September 2011 at the North American Biomass Pellet Export Conference.

|

|

| Representatives from European utilities and pellet traders kicked off the conference with an overview of current pellet use. From left: Henry Pease of RWE Supply & Trading; Niels Bojer Jørgensen, purchaser for Denmark’s Dong Energy; Simon Rodian Christensen of Copenhagen Merchants; Ben Goh, senior biomass fuel developer for German utility Eon; Nicolas Denis of McKinsey Consulting; and panel moderator Thomas Meth, executive vice-president of U.S. pellet producer Enviva.

|

The increasing demand for pellets will intensify producer competition, particularly with new entrants from low-cost regions outside North America, such as Brazil and Russia, said Jonathan Rager of Pöyry Management Consulting. With the European Union predicted to remain the most important market (and smaller growth in Asia and North America), regions of the world that have a sustainable, low-cost fibre supply and short-distance shipping access to Europe should benefit most. Something for North American pellet exporters to keep an eye on, said Rager, is “where that new supply will go, and how it will affect the existing markets.”

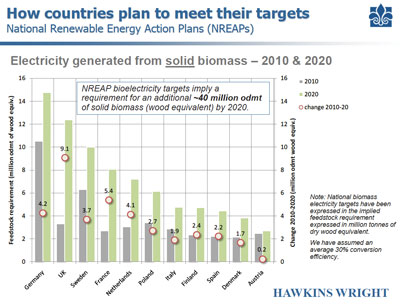

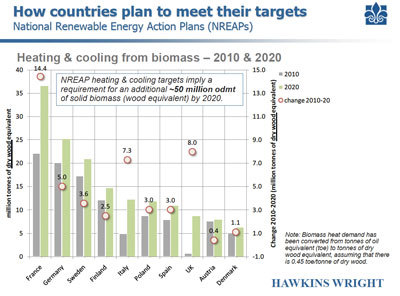

“The European Union is still where the game is, from an industrial pellet perspective,” said John Bingham of UK-based Hawkins Wright, a forest markets consultancy. About 90% of EU biomass import demand currently goes to the UK, Netherlands, Sweden, Denmark, Belgium, and Italy. Based on EU member countries’ renewable energy plans, Bingham expects to see growth of 40 million and 50 million oven-dried tonnes of biomass for the power and heating markets, respectively, by 2020. Major growth markets will be Germany, UK, Italy, Sweden, Netherlands, and Poland for power generation, and France, Germany, Italy, UK, and Sweden for heating and cooling. However, Germany, France, and Poland should be able to meet their supply from domestic sources, said Bingham. These markets will continue to be highly dependent on policy direction, he added.

Key criteria

Sustainability was a key buzzword throughout the conference. “Sustainability to biomass is like safety to nuclear,” said Ben Goh of Eon, a Germany-based power and gas company. “Utilities must be seen to be acting in a manner consistent with sustainability.” With the EU establishing criteria for sustainably harvested biofuels, North American pellet producers are eager to see some final policy direction so they can ensure their pellets will meet the standards.

Currently, a major challenge for pellet producers is that each utility sets its own pellet specifications. Simon Rodian Christensen of Copenhagen Merchants, which ships and handles pellets and owns several port terminals, gave numerous examples. Some power plants require low fines/dust if located near residential areas or if the pellets need to be handled multiple times. Utilities can also differ in requirements for nitrogen level, ash content, and pellet diameter, contract term, shipment size, etc. This means that producers need to understand as many specs as possible and be able to meet them, said Christensen, illustrating the need to commoditize pellet trading with standardized specs and contracts.

“It’s not a question of if, but when it will be a commodity,” stated Henry Pease of RWE Supply & Trading, a European energy trading house. Establishing standardized contracts, sustainability criteria, and credible certification will go hand in hand in gaining commodity status for wood pellets. All of these are currently in development.

|

|

| European Union countries’ renewable action plans predict a 40-million oven-dried tonne increase in biomass use for renewable electricity. | |

|

|

| European Union countries’ renewable action plans predict a 50-million oven-dried tonne increase in biomass use for the often overlooked heating and cooling sector.

|

Economies of scale

Logistics and transportation speaker panels emphasized that the future of North American pellet production and transport will be all about economies of scale. Only the most efficient producers will remain competitive, with smaller plants being edged out of the market, and larger plants gaining from efficiencies of scale, said Nicolas Denis of McKinsey Consulting. However, optimal plant size will vary, as production will be constrained by the carrying capacity of a particular region. At some point, a plant will become its own wood fibre competitor, noted Steven Meyers, Fram Renewable Fuels’ wood procurement manager. The trick will be in finding the right production capacity for each fibre basket.

Economies of scale in shipping also currently benefit larger producers. Henrick Christiansen of Oldendorff Shipping, a dry bulk shipping company out of Germany that handles wood pellets, estimated that the best volumes are about 25,000 tonnes if shipping pellets from the east coast of North America and 40,000 to 45,000 tonnes if shipping from the west coast. “The smaller you go, the more expensive it gets,” he said.

In fact, larger volumes could be shipped if the ports were capable of handling them, said David Elsy of ICAP Shipping. However, he noted that few U.S. ports have a draft greater than 50 feet (15 metres) to accommodate larger ships, and loading those volumes within the short time allotted at port can be difficult. Port storage capacity also limits the cargo volume, added Christiansen.

Maximizing shipping volumes is problematic for smaller plants that might only have a 50,000-tonne/year production capacity. Pellet commoditization would alleviate some shipping costs by allowing the blending of pellets from multiple producers. However, certification will likely be more costly per unit production for smaller producers.

Print this page