Pellets in Japan

December 1, 2017

By William Strauss

2016 aggregate demand for industrial pellets used to replace coal in power generation is estimated to be about 14.2 million metric tons. That is the equivalent of a bulk carrier ship carrying 40,000 tonnes about every day.

The majority of demand growth for industrial wood pellets after 2019 is expected to come from Japan and South Korea. 2016 aggregate demand for industrial pellets used to replace coal in power generation

The majority of demand growth for industrial wood pellets after 2019 is expected to come from Japan and South Korea. 2016 aggregate demand for industrial pellets used to replace coal in power generationThe majority of demand growth for industrial wood pellets after 2019 is expected to come from Japan and South Korea.

Japan versus South Korea

Both the Japanese and S. Korean markets for industrial wood pellets are driven by policies that are quite different. However, both policies result in creating a demand for industrial wood pellets as a coal replacement in power plants.

How the supply for those wood pellets is secured in each country is also quite different.

Japanese buyers, supported by a long-term feed-in-tariff (FIT), prefer long-term offtake contracts with set terms for prices. The basis for the policies in Japan is the decarbonization of the power sector, which requires suppliers to show that the pellet supply chain meets sustainability criteria. Japanese buyers therefore prefer to engage with counterparties from countries with strong rule of law (for comfort with the durability, consistency, and security of the supply agreement), strong forest management practices, and stable macroeconomic conditions.

S. Korean buyers, incentivized by the need to comply with the S. Korean renewable portfolio standards (RPS) supported by renewable energy certificates (RECs), and to a lesser degree from carbon trading in the Korean Emissions Trading scheme (KETs), are currently seeking the lowest cost pathway to compliance. Some of the RPS compliance for generating a proportion of power from renewable sources has been from wind and solar generation. But some compliance has been via co-firing pellets. S. Korea, to date, has procured pellet fuel under a short-term tendering strategy that has producers competing several times per year to win supply bids to the individual utility buyers. S. Korean buyers prefer short-term supply contracts from low-cost producers.

Japanese policy

Japan is guiding its power generation industry with four interlinked areas of policy: carbon reduction, the “best energy mix for 2030,” required efficiencies for power generation, and the FIT.

The only policy instrument that provides a monetary incentive is the FIT.

Carbon emissions targets

Japan has already implemented a target reduction of CO2 emissions that requires all power companies to reduce CO2 per kWh by 35 per cent from 2013 levels by 2030. This is a reduction from 0.57kg of CO2/kWh to 0.37kg of CO2/kWh. It is currently a voluntary target but a few major utilities are already co-firing wood pellets at modest one to three per cent ratios.

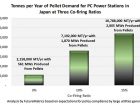

There are a few pulverized coal (PC) power stations currently co-firing wood pellets in Japan, and there are some having discussions for pellet fuel supply with major producers. Those stations that are either currently co-firing or in discussions about fuel supply add up to about 18,700 MWs. Graphic 1 shows the pellet demand at these stations under three co-firing ratios. At the higher co-firing ratios, the plants may need modifications and/or retrofits to pulverizers, burners, pneumatic fuel conveyance systems, and some other components.

It is unlikely that co-firing ratios for the large utility generators will exceed 15 per cent as will be discussed more fully in the section on the FIT.

The voluntary policy for carbon emissions mitigation may change to required reductions. Japan has committed to the international agreement for CO2 reduction. That target is for a 27 per cent reduction by 2030.

Some of that CO2 reduction will be achieved with renewables and some with nuclear. The government’s energy mix goals show how this might be achieved.

Best energy mix

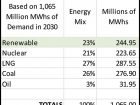

The Japanese government’s analysis (from METI, the Ministry of Economy, Trade, and Industry) expects the nation to demand about 1,065 million MWhs in 2030. The government’s strategic plan includes a breakdown of the desired energy mix in 2030. The nation will be expected to produce power based on the breakdown shown in Graphic 2.

Within the renewables, biomass is 4.3 per cent of the 245 million MWhs per year allocated to renewables. To meet that demand in 2030, Japan will have to have generation capacity of just over 6,000 MWs from biomass. If 30 per cent of that 6,150 MWs (1,845 MWs) are generated from

pellets, Japan will consume about 7.4 million metric tons per year of pellets.

To meet that demand in 2030, Japan will have to have generation capacity of just over 6,000 MWs from biomass. If 30 per cent of that 6,150 MWs (1,845 MWs) are generated from pellets, Japan will consume about 7.4 million metric tons per year of pellets.

Minimum generation efficiency requirements

The Japanese regulators have set minimum generation efficiency requirements for all large coal power generation stations. The minimum requirement will be 41 per cent and will have to be met by 2030. Currently only the ultra‐supercritical pulverized coal plants meet this requirement.

The Japanese Ministry of Economy, Trade and Industry (METI) has allowed the formula for calculating efficiency to be modified to encourage the use of wood pellets as a substitute for coal to “change” the efficiency calculation. Typically, efficiency (or heat rate) is based on the energy output versus the energy input. For example, if 100 MWs of energy are put into the boiler and 35 MWhs of electricity is generated, the efficiency is 35 per cent.

The modification to the calculation is to allow any MWhs generated from wood pellets to be subtracted from the denominator. Thus the calculation for the example would now be:

If the plant was producing 35MWhs and the total power is 100 MWhs but the power from pellets is 15 MWhs, the “efficiency of the plant would be 35/(100‐15) = 41 per cent. In other words, PC power plants with efficiencies below 41 per cent can co-fire wood pellets to achieve the minimum efficiency requirement.

The supercritical and subcritical plants that continue to operate will have to co-fire pellets if, for no other reason, to meet this requirement.

Given 17 GJ/tonne pellets, these selected power plants will have to consume about 2.13 million tonnes of pellet fuel.

Feed-in-Tariff

Of the four policy instruments in Japan, the FIT provides the direct financial support to power generators that will compensate them for the higher cost of generation with pellet fuel.

The FIT scheme started in July 2012. Under the FIT, electric power transmission and distribution companies are obliged to purchase electricity generated from renewable energy sources on a fixed-period contract at a fixed price. The cost for purchasing the renewable power is paid by electricity users in the form of a nationwide equal surcharge on power bills.

Since 2012, purchase prices of the FIT have been reexamined by METI. The FIT price for solar PV has been lowered and some new categories have been created for wind, hydro and biomass.

The FIT for pellet fueled power generation will be lowered to ¥21/kWh in October 2017 from its current ¥24/kWh (from about $0.22 to about 0.19 per kWh at 111 yen per dollar). The duration of the FIT is 20 years from the start of the project. However, the FIT is not adjusted for inflation. It is a fixed payment per MWh for 20 years.

(If the Japanese utility is to avoid the risk of the fuel becoming too expensive given the fixed FIT, they will have to engage in offtake agreements that are based on a known starting $/tonne with a fixed escalation rate. The cost of pellets cannot go too high over the term of the offtake agreement such that the cost of generation causes the power station to have their bottom line go negative. There are many inputs to determine the “levelized cost of energy” and the expected revenues from the sale of coal generated power and the portion generated from wood pellets that does receive the FIT. FutureMetrics can provide detailed analytics on identifying and minimizing the risks in an offtake agreement for supplying pellets to Japan.)

There is no upper limit restricting the size of a power plant benefiting from the FIT for new power plants. But there is a de‐facto limit due to permitting. If the power plant is less than about 110 MWs, then a full environmental assessment is not required. For a small plant the assessment takes one or two years. For proposed plants that are larger than about 110 MWs, the full assessment requires at least five years. Most of the current and planned FIT projects are smaller independent power producers (IPPs).

Due to the carbon policy, the “best energy mix” policy, and the required minimum efficiency requirement, some of the major power generators will be forced to co-fire pellets. The major power generators who need to co-fire pellets at their existing power stations will likely be allowed to benefit from the FIT (for the MWhs generated by pellets) and co-fire at the rate of up to about 15 to 20 per cent. However, as noted above, at a 10 per cent co-firing ratio, it is possible to reach the “best energy mix” criteria.

At a co-firing ratio of 10 per cent by selected major utility power plants, the demand for wood pellets is expected to exceed seven million tonnes per year.

Japanese growth

There are numerous projects planned and many are currently either co-firing wood pellets or running dedicated systems using pellets or low grade biomass or palm kernel shell (PKS).

(For example: according to reports, U.S. wood pellet producer Enviva, and sponsor Enviva Holdings, has signed an initial agreement with a Japanese trading house for 650,000 t/yr of supply to a dedicated biomass-fired power plant in Japan. The dollar‐denominated, 15-year contract is expected to commence in 2022, subject to documentation of the definitive agreement and contract particulars, and will fully cover the power plant’s needs. The dedicated plant is the largest announced in Japan to date. Enviva is in discussions with other large Japanese trading houses, utilities and independent power producers that are looking to build more than a combined 1.7GW of biomass-fired generation capacity. The negotiations are “well on track.” Those projects would create more than 7mn t/yr of wood pellet demand, although Enviva does not expect all the capacity to be constructed. Enviva has been eyeing the growing Japanese biomass market in recent years, but, as yet, only minimal U.S. wood pellet exports have made it to Japan, which sources most of its imports from Canada’s west coast. Japan imported 150,500t of wood pellets from Canada in the first half of this year, compared with just over 100t from U.S.)

Most of the currently running dedicated systems are relatively small circulating fluidized bed (CFB) boilers that do not have pulverized fuel systems. CFB boilers can burn a wide range of biomass fuels, including wood pellets. However, most will likely use palm kernel shell (PKS). PKS is not pulverizable and cannot be used in PC boilers.

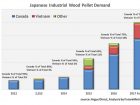

Actual demand though 2016 and forecast demand for 2017 is shown in Graphic 3. Canada continues to be the major supplier of wood pellets to Japan and is expected to be a major supplier into the 2020s.

A significant proportion of current biomass demand in Japan is satisfied by the import of palm kernel shell (PKS). All PKS imported into Japan comes from Indonesia or Malaysia.

Conclusion

The large power stations owned by the major Japanese utilities are being guided into decarbonization with the limits on CO2 per MWh, with compliance to the “best energy mix,” and with improved efficiency that allows the wood pellet generated portion of the total power output to “improve” efficiency.

The 20-year duration of the FIT, starting at very generous rates that are more than double the average spot rate in Japan, will support long-term and stable demand for industrial wood pellets. (In the summer months on very hot days the spot rate may exceed ¥25/kWh. The average over a year is under ¥10/kWh.) However, given that the FIT is fixed for 20 years, those long-term agreements with Japanese buyers will likely require known starting prices and fixed price escalators.

Given a set starting price and a fixed annual increase in price, inflation risk will be borne by the producers. Understanding that risk and setting the terms of the agreement are critical to the financial durability of the deals. Nonetheless, there is an expected large and stable market in Japan bringing significant potential for healthy sustainable growth in industrial pellet production.

FutureMetrics is a leading consultant in the wood pellet sector. William Strauss is its president and founder. Visit www.futuremetrics.com.

This article originally appeared in the October 2017 issue of Wood Bioenergy.

Print this page