Advanced Biofuels

October 20, 2009

By

Heather Hager

With all the talk about the development of second-generation biofuels like cellulosic ethanol, foresters and farmers may be wondering when they will be able to take advantage of this market by supplying biomass feedstocks.

With all the talk about the development of second-generation biofuels like cellulosic ethanol, foresters and farmers may be wondering when they will be able to take advantage of this market by supplying biomass feedstocks. Unlike commercially produced grain ethanol and biodiesel, however, cellulosic ethanol production in Canada is still largely at the small-scale pilot, or testing, stage. Pilot plants are usually run on a limited basis, and evaluations and improvements are made after each run to increase operational efficiencies.

|

|

| Cellulosic ethanol production may involve a distillation step to separate the ethanol from water and other compounds formed during the conversion process. Photo: Lignol

|

Still, there’s a push to use nonfood sources to meet growing biofuel demands. The federal government’s Bill C-33, passed in June 2008, mandates 5% ethanol in gasoline by 2010 and 2% biodiesel in diesel by 2012. Some provincial standards are already higher.

“Canada consumes about 40 billion litres/year of gasoline,” says Jeff Passmore, executive vice president of public affairs for Iogen, an Ottawa-based developer of cellulosic ethanol technology. “Five percent of that would be two billion litres. We currently produce in Canada about 1.3 billion litres of ethanol, so we’re 700 million litres short.” To minimize increases in grain-based ethanol and biofuel importation to meet this shortfall, one desire is to expand the domestic industry by producing cellulosic ethanol.

What is cellulosic ethanol?

Unlike grain ethanol, which is produced from edible plant parts by fermenting and distilling the simple starches and sugars, cellulosic ethanol is produced from nonedible plant materials such as stems, pits, and branches. This gives more options for feedstocks, which can come from forestry and woody residues, agricultural residues, bioenergy crops, and even sorted municipal solid waste. However, this biomass is mainly composed of lignin, hemicellulose, and cellulose, which are difficult to separate, and the cellulose must somehow be extracted and broken into fermentable sugars. Although there are several ways to do this, the major stumbling block is in making them economical.

There are two general approaches to pre-treating cellulosic feedstocks. In biochemical methods, the feedstock is broken down by pre-treatment with dilute acids, steam explosion, ammonia fibre explosion, or organic solvents. Enzymes then chop the cellulose into smaller sugars for fermentation, followed by distillation. However, the costs of pre-treatment and enzyme production, although supposedly decreasing, still remain prohibitive.

In thermochemical methods, the feedstock is gasified (high-temperature, low-oxygen combustion) to produce synthesis gas, or syngas. The syngas is cleaned and then either fermented by microbes or reacted with a catalyst to produce ethanol or other chemicals. This avoids the difficulty of extracting and breaking down the cellulose, but requires the development of catalysts that are both effective and inexpensive.

The players

The main Canadian companies that are pursuing cellulosic ethanol production have yet to make quantities at commercial scale, although some say they’re getting close. Most are expecting to move to commercial production in a few years. However, one Canadian company has already been producing ethanol from hemicellulose for more than 15 years.

Tembec, headquartered in Temiscaming, Quebec, produces up to 18 million litres/year of ethanol as one product of a sulphite pulping process that produces specialty cellulose. The feedstock is wood chips, which are digested under heat, pressure, and acidity to separate the fibre components. The purified cellulose supplies pharmaceutical, food, and other industries. As one byproduct, hemicellulose is fermented to produce ethanol, which is not used as fuel ethanol, but supplies industrial markets such as vinegar production.

|

|

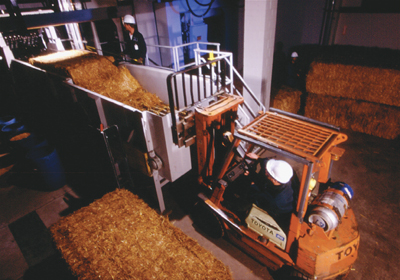

| Regardless of the type of feedstock, pre-treatment such as grinding the biomass reduces the particle size to facilitate reactions and is a necessary step in the process. Photo: Iogen

|

Although Tembec’s research has determined that it could produce cellulosic fuel ethanol, it’s currently not economical to do so, says Randy Fournier, senior vice-president of Tembec’s chemical group. “Lots of people have found various ways to go from cellulose to ethanol. It’s the economics that ultimately have to be improved upon before it will become commercially viable.” He says that Tembec prefers to continue with its current production model, which could allow future adaptations for cellulosic ethanol, rather than trying to improve or invent technology as a new entrant into the cellulosic ethanol industry.

In contrast, several Canadian companies are aiming to produce cellulosic ethanol as their main product: Enerkem, Greenfield Ethanol, Iogen, and Lignol, to name a few. Of these, Montreal-based Enerkem has taken the gasification approach. Its first pilot plant, in Sherbrooke, Quebec, has been operating since 2003 and has tested over 20 types of feedstock, including sorted municipal solid waste (MSW), treated and untreated wood, and agricultural residues.

“The main difference with our method, using the thermochemical approach, is that it can deal well with chemical impurities in the feedstock,” says Vincent Chornet, president and CEO. So Enerkem can process feedstocks such as chemically treated wood and sorted MSW. In fact, its first small commercial-scale plant in Westbury, Quebec, takes decommissioned electricity poles, which contain hazardous chemicals. A local sawmill reuses the untreated centre wood, but 80% of the pole is unusable and would normally be sent to a landfill. “The sawmill is now shredding it and supplying us with that residue, and paying us to take it,” says Chornet. The hazardous chemicals are broken down and/or recycled during gasification and ethanol production.

The Westbury plant began a start-up phase in January 2009 and is currently producing syngas. Monitoring is ongoing to ensure that the cleaned and conditioned syngas is of consistent quality, after which modules that convert the syngas to ethanol will be added to the system. The plant’s capacity is 5 million litres/year of ethanol.

Enerkem recently partnered with Ontario-based Greenfield Ethanol to build a second commercial-scale plant in Edmonton, Alberta, with an initial capacity of 36 million litres/year. In late May 2009, Enerkem Greenfield Alberta Biofuels received a permit to begin construction, which is slated to start in late 2009. The City of Edmonton will supply 100,000 dry tonnes/year of sorted MSW under a 25-year agreement signed in June 2008.

Greenfield Ethanol, which has a number of corn ethanol plants, established a cellulosic ethanol division in 2007. In addition to its partnership with Enerkem for Edmonton’s municipal waste gasification-to-ethanol plant, it is exploring biochemical methods to produce ethanol from biomass. Initially, it is pursuing corncobs as the feedstock for supplemental facilities at existing corn ethanol plants. Its 85,000 litre/year pilot plant at Chatham can take about 1 tonne/day of corncobs for pre-treatment; the fermentable product enters the grain ethanol stream.

|

|

| Feedstocks for cellulosic ethanol range from agricultural residues such as corncobs and straw to wood and sorted municipal solid waste. Photo: Greenfield Ethanol

|

Greenfield concentrated on corncobs first because they are a readily available agricultural byproduct and are fairly easy to break down; corncobs have on average half the lignin content of wood. Most of the process has been worked out for corncobs, says Frank Dottori, director of Greenfield’s cellulosic ethanol division, and the former head of Tembec. He says that Greenfield intends to begin working with additional available feedstocks such as grasses and, eventually, wood.

The company has received approval to scale up to a larger, pre-commercial facility that would produce about 4 million litres/year. “We think we’ve solved the problem of making ethanol out of corncobs in a relatively economical fashion,” says Dottori. “We have received $12.3 million in federal and provincial support if we proceed with the plant.” Final budgeting and decisions on which pre-existing facility would receive the plant are under discussion. The company also hopes to develop value-added solutions for the byproducts of the process.

Iogen and Lignol have also taken biochemical approaches to producing cellulosic ethanol. Similar to Greenfield, Iogen uses primarily agricultural residues as its feedstock. Its demonstration facility in Ottawa, Ontario, has been running since 2004 and has a capacity of 5,000 to 6,000 litres/day. Iogen’s cellulosic ethanol has been blended with gasoline and used in a variety of applications. The Ottawa facility uses primarily wheat and barley straw, most of which is currently provided by one supplier.

Iogen’s next potential project, pending final investment decisions following the completion of design and feasibility studies, is a commercial-scale plant in Prince Albert, Saskatchewan. Approximately 600 area farmers have signed contracts to sell straw to the plant, says Passmore. Iogen would purchase some of Domtar’s idle Prince Albert pulp mill assets to establish the facility, which would also include a power plant to produce electricity from forestry and ethanol production residues. Initially, the facility would take an estimated 750 tonnes/day of straw from within a 100–120 km radius to produce about 70 million litres/year of ethanol. Phase two of the development would double that capacity.

In contrast to Iogen, Lignol, of Burnaby, British Columbia, is currently focused on forestry waste and pine-beetle-killed wood as its feedstock, although it has worked with feedstocks like agricultural residues and bioenergy crops in laboratory tests. Lignol has a very small pilot plant that tests volumes of up to 20 litres/day and has recently scaled up to a larger pilot plant with a capacity of 100,000 litres/year. This pilot plant completed its first end-to-end production of cellulosic ethanol from wood chips in June 2009 and will continue testing various nonfood feedstocks under a wide range of operating conditions.

Lignol uses a proprietary process to solubilize and separate the cellulose, hemicellulose, and lignin that does not involve acid hydrolysis or steam or ammonia explosion, says Ross MacLachlan, president and CEO. “This leaves us with the pure cellulose, which allows the enzymes to break it down much more efficiently.” The hemicellulose and high-purity lignin are removed and used for other commercial applications, generating additional revenue streams.

Challenges

Despite the advances of these Canadian industry leaders, there have been other proposed and initiated projects that are discontinued or postponed because of the difficulties involved in breaking into the cellulosic ethanol industry. Obstacles include the high costs of some of the current conversion technologies, a lack of funding and investors, the recent economic slowdown, and low or falling crude oil and fuel ethanol prices. It seems that for these reasons, newer operations tend to keep a low profile. Some ventures will surface only briefly and then disappear; others will announce their presence only once they are close to being fully operational.

|

|

| Enerkem’s gasification to ethanol process is feedstock flexible, but the company currently focuses on waste wood and sorted municipal solid waste. Photo: Enerkem

|

By far, likely the greatest challenge is in making cellulosic ethanol production an economical enterprise. Some methods may be closer to this than others. For example, gasification technologies that can take negative-cost or no-cost feedstock may have an advantage over those that must purchase feedstocks. However, the ultimate outcome will depend on factors such as feedstock availability, enzyme costs, and catalyst costs, to name a few. Most proponents believe that it is important to continue to develop multiple technologies.

Technological challenges are a considerable hurdle to the economical production of cellulosic ethanol. Both the separation of the tightly bound lignin and cellulose and the production of enzymes to break down cellulose are expensive, and much of the research and development focuses on improving these steps. Integrating the biochemical or thermochemical processes with final fermentation and/or distillation is also a factor.

However, the difficulty cited most often is in obtaining financing for research, development, and scaling up processes. “We’re delighted to have received government support,” says Greenfield’s Dottori, “But it isn’t available at the same level as elsewhere.” He thinks that this could put Canadian companies at a competitive disadvantage.

MacLachlan of Lignol agrees. “We need government assistance on the capital to get the technology through the first few scale-ups that are required.” In addition, he says, “We need government policy that gives some certainty to the market, something that says ethanol is here to stay. We need to have firm markets.”

“I think it’s very key that the government, which has a vested interest in seeing an alternate fuel economy grow, be very supportive of projects like ours,” says Enerkem’s Chornet. “I think that government has to be at the centre of this industry, with a barrel of oil that is still close to $60 today. We’re seeing strong signals of that happening in the United States with the stimulus package, and also in Canada, with the government supporting the 5% mandate and announcing new funding programs.”

A particular complication that MacLachlan identifies for wood-based cellulosic ethanol production is the capacity to access the resource. For companies that obtain wood waste feedstocks from the forest industry, forest tenure policies can be problematic, he says. For instance, a sawmill that provides wood waste could close, but its access to the underling timber assets might still be held by the parent company, making the timber and associated biomass off-limits to other users. “So forest tenure reform, to start making the underlying biomass available to applications in other technology, is really critical.”

Regardless, biomass producers will have to look elsewhere until cellulosic ethanol plants are ready to begin processing biomass on a large scale. Until cellulosic ethanol becomes economically viable and facilities require a steady stream of biomass, forestry and agriculture will need to explore other uses of biomass such as power generation, combined heat and power, district heating, pellet production, and other markets. •

Print this page