Fibre to Burn?

August 7, 2009

By Jim Girvan and Murray Hall

Nowhere in Canada is the buzz about forest biomass and its use for energy production heard more often than in British Columbia. In 2007, the BC Government announced the BC Energy Plan (the Plan), a key component of which was the development of the BC Bioenergy Strategy.

Nowhere in Canada is the buzz about forest biomass and its use for energy production heard more often than in British Columbia. In 2007, the BC Government announced the BC Energy Plan (the Plan), a key component of which was the development of the BC Bioenergy Strategy. The latter will take advantage of the province’s notionally abundant sources of renewable energy, such as mountain pine beetle (MPB) killed timber, wood wastes and agricultural residues to produce power.

|

|

| As some BC Interior sawmills face volume reductions from ageing beetle-kill wood supplies, they’ll make less lumber, and thus fewer residuals. The result will be more competition for low-grade fibre in the woods.

|

On the heels of the Bioenergy Strategy, BC Hydro, the provincial

regulator for power purchase and distribution, launched its Phase I

Call for Power. Phase I focused on bio-energy projects that were

immediately viable and did not need any allocation of new harvesting

tenure from the Ministry of Forests and Range.

Then on March 5, 2009, BC Hydro launched the second phase of the Bioenergy Call for Power. Phase II will involve two separate streams, with the first targeting larger-scale biomass projects, and the second focusing on smaller-scale, innovative, community-level energy solutions using biomass.

In April of 2008, the BC Bioenergy Network was established with a $25 million grant from the BC government. This industry-led initiative will act as a catalyst for deploying near-term bioenergy technologies and will organize mission-driven research for the development and demonstration of new bioenergy technologies that are environmentally sustainable. Notably missing from their mandate, however, was any attention to biomass inventory or availability.

Despite a seemingly endless sea of dead pine at its doorstep and strong BC government support for the development of new bioenergy-based initiatives, little work has been done to quantify how much forest-based fibre might actually be available to support a new biomass industry, let alone to determine the delivered cost of that fibre supply.

Think before acting

By their nature, biomass-based projects are long-term and require sustainable fibre supplies for at least 10 to 15 years to support the amortization of investment capital. While at first glance the immense destruction of BC’s interior forests by the MPB would suggest a limitless supply, closer inspection reveals the need for caution.

|

|

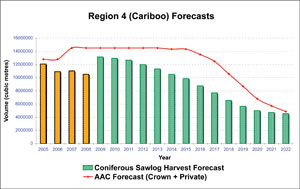

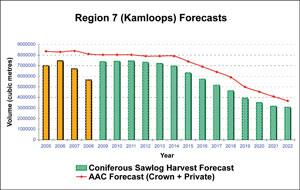

| Chart 1 shows the forecast of aggregated regional AAC within the Cariboo and Kamloops regions, with corresponding sawlog availability estimates based on the application of current shelf-life thinking to the dead MPB impacted timber.

|

The BC Fibre Model is a proprietary fibre forecasting tool developed by Jim Girvan and Murray Hall, two independent fibre practitioners from Vancouver Island. The model is essentially a snapshot of the entire BC forest industry including AAC and sawlog availability, industrial sawlog demand, residual chip output, pulp and paper consumption and minor residual balances, including an assessment of available biomass.

It allows users to input assumptions related to the operation of the BC forest sector, such as mill operating rates in the face of changing (improving) economic indicators, allowable cut partitions to MPB killed timber, shelf-life forecasts, mill closures and forecasts of new biomass demand. The model then provides forecasts, out to 2022, of the regional balances (or deficits) for sawlogs, residual wood chips, sawdust and shavings, hog fuel, and of course available residual biomass. The first four years of data are benchmarked to known industry performance, thereby making forecasts more credible.

|

|

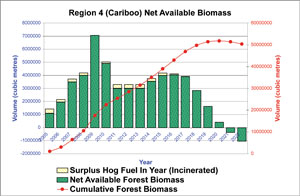

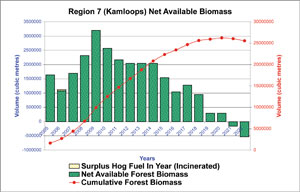

| Chart 2 shows the forecast of the annual and accumulated forest-based biomass in the Cariboo and Kamloops forest regions.

|

“The model puts a lot of data into an easy to read and understandable format. It has helped us understand fibre issues as part of our strategic planning work,” notes Craig Garratt, general manager of fibre supply for Canfor Pulp Limited Partnership in Prince George.

With the biomass forecast, we are trying to determine what volume of biomass is forecast to exist within the framework of the AAC that will not be consumed by the existing forest industry over time, and so could potentially be available for other, new biomass consumers.

By definition, annual biomass accumulations in the model are:

- Surplus coniferous saw logs.

- Harvest (and waste) of dead pine not consumed by the existing forest sector.

- The non-sawlog component of any “green coniferous harvest” not consumed.

- All unharvested AAC.

- Surplus hog fuel.

So what does the forecast of available biomass in BC suggest? Let’s look regionally.

Think globally, harvest locally

With the epicenter of the MPB epidemic in the central interior, regions like the Cariboo and Kamloops have a significant pine component to their forests and have elevated allowable harvest levels designated to support the auspicious recovery of the dead timber. They are thus seemingly good candidates for the supply of forest-based biomass to support new biomass based initiatives.

|

|

| The accumulated surplus of biomass in the field will depend on how much is left to accumulate, and how much is burned.

|

However, before we start handing out forest licenses to provide fibre for new power, pellet or cogeneration plants, we must look realistically at the available supply of dead timber, the likely allowable harvest levels over time, and just what fibre the existing industries in those regions will require.

Chart 1 shows the forecast of aggregated regional AAC within the Cariboo and Kamloops regions, with corresponding sawlog availability estimates based on the application of current shelf-life thinking to the dead MPB impacted timber. As can be seen, both regions will have their AAC reduced as the limits of salvage in the MPB are reached. In addition, sawlog availability will fall as the shelf-life of MPB killed timber yields less and less sawlog material over time.

The implications of these charts are twofold. First, as the AAC falls to the mid-term sustainable level, the resulting level of allowable harvest will simply yield less wood fibre to be available to support new or existing industries. Second, reductions in sawlog availability over time will likely trigger capacity closures by regional sawlog consumers, primarily sawmills.

Regional sawmill closures will mean less residual wood chips, sawdust, shavings and hog fuel to support existing pulp, paper, power and pellet production. This reality will trigger the need for these industries to turn to the accumulation of forest biomass to support their operations. And while the AAC forecast presented above is scary to say the least, the fact that the fall is predicted to happen within 10 years suggests that to support growing bioenergy businesses within BC, some of the current users of forest-based biomass may have to close. Can pulp and paper mills compete with new biomass based industry for the same wood? Will new biomass industries be supported by government to the detriment of the existing ones? Will the levels of employment in a biomass energy plant for example, be the same as for a pulp and paper mill? These are all important questions that need to be considered when we look at the reality of a declining regional and provincial fibre basket.

So if we assume that the AAC and sawlog availability will follow the trend predicted above, and then further assume that existing pulp, paper, power and pellet industries will not close in the face of falling residual fibre availability, what does the forecast for residual forest-based biomass look like?

Chart 2 shows the forecast of the annual and accumulated forest-based biomass in the Cariboo and Kamloops forest regions. As can be seen in both regions, biomass accumulates annually over time until the point where sawmill capacity closures are expected to occur.

In the Cariboo, accumulated biomass totals as much as 50 million cubic metres and the Kamloops region suggests 25 million cubic metres. However, as capacity closures occur, the existing pulp, paper, pellet, power and board plants reliant on residual fibre from regional sawmills will be forced to turn to the inventory of unused forest-based biomass to supplement their need for fibre.

By as early as 2020, at the point where the AAC has been reduced to the mid-term sustainable level and sawmill capacity has been rationalized in the face of falling sawlog supply, biomass is no longer accumulating within the forest and the inventory is being drawn down. In the Cariboo, annual demand for forest-based biomass is forecast to exceed 1 million cubic metres per year, whereas in Kamloops, it is closer to 500,000 cubic metres annually.

While the accumulation of biomass appears large and suggests a significant accumulation opportunity within the forest, the million dollar question is how long will the accumulated biomass in the forest last if so many existing industries are going to be reliant upon it?

As indicated above, the forecast is an accumulation of available biomass, within the framework of the AAC that is, in essence, not forecast to be used by any other consumer. The accumulation assumes that if wood fibre is not used in a single year, that it then becomes available for use (i.e., accumulated as biomass) in subsequent years. There are three cautionary notes in this regard, however:

- The forecast does not include biomass-based industries that are planned to start up in the near future. In the Cariboo, an OSB plant that consumes as much as 1 million cubic metres per year is required to support an existing harvesting licence there. That plant alone, if it were to come on line before 2020, would reduce the available biomass within the region by close to half. In the Kamloops region, announcements of new pellet plants that will be supported by a 3 million cubic metre licence were made recently.

- In this forecast, unharvested AAC contributes to biomass. This is essentially undercut that is assumed to be carried forward. Forest policy may dictate that this volume may not available for future use but will remain as a contributor to future AAC calculations.

- The accumulation of biomass assumes no fire hazard abatement. In these forecasts we are assuming that waste piles created by the harvest and subsequent piling of non-sawlog material remains available for use over the planning horizon. In practice, firms will move to reduce the hazard by burning waste piles, effectively removing the accumulation from the biomass inventory,

In application, the combination of these factors would suggest the gross forecast of accumulated forest-based biomass within both of these regions shown above is optimistic at best. Could the actual level of available biomass be one-half or one-third? If so, then within 15 years none of the existing biomass-based industries will be able to exist, let alone any new industry that will be competing for this very same material, as a result of a lack of fibre.

The volume of fibre available and the cost of that fibre is a critical question to be resolved if we are to move forward with significant investments in new technology to consume biomass within BC. These forecasts suggest caution, or at least a discussion about who should close down and who should start up in the face of a limited supply of biomass. Is closing a pulp mill in favour of opening a power plant in BC the answer? Can existing board and pellet plants compete with government-supported new biomass technology?

We should have the discussion and consider the analysis before we pit them against each other in the BC fibre market. •

Jim Girvan, RPF MBA, is the principal of MDT Management Decision and Technology of Ladysmith, BC, where he provides consulting support in the areas of timber supply and fibre flow modeling and analysis, industry forecasting, statistical analysis, licence acquisition and forest policy. Murray Hall, BComm, is the principal of Murray Hall Consulting Ltd. of Duncan, BC, where he provides consulting support in the areas of residual fibre analysis, fibre quality and strategic assessments of wood supply.

Print this page