WPAC – U.K. Energy Act receives royal assent

February 11, 2014

By Gordon Murray

The U.K. Energy Act received royal assent from the Queen on Dec. 18, 2013.

The U.K. Energy Act received royal assent from the Queen on Dec. 18, 2013. This was the culmination of a long process, which began as a government consultation in December 2010. The consultation led to a White Paper on Electricity Market Reform in July 2011, which in turn became the draft Energy Bill. The Energy Bill was introduced to Parliament in November 2012, and after much debate, finally became law in December 2013.

Of particular interest to wood pellet producers is that the Act provides for Electricity Market Reform (EMR). The government is required to publish an EMR Delivery Plan every five years and the first such plan was delivered on Dec. 19, 2013, just one day after Act became law.

The government’s EMR objectives are: (1) to ensure a secure electricity supply through sufficient capacity to meet any demand, a diverse portfolio of generation technologies and a reduced reliance on fossil fuels; (2) to ensure sufficient investment in sustainable low-carbon technologies to provide the necessary support and stable revenues to decarbonize electricity generation; and (3) to do so in a way which maximizes benefits and minimizes costs to the U.K. economy and to taxpayers and consumers.

The government will meet its EMR objectives by using two mechanisms: Contracts for Difference (CfDs) and the Capacity Market. These mechanisms will be supported by:

- A tax on fossil fuels used to generate electricity;

- Limiting CO2 emissions from fossil fuel power stations;

- Incentivizing electricity demand reduction; and

- Supporting market liquidity and access to market for independent renewable generators.

Contracts for Difference

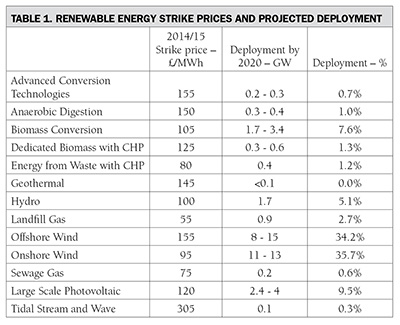

CfDs will support low-carbon generation by giving eligible generators increased price certainty through a long-term contract. A CfD will largely remove exposure to volatile wholesale prices during the CfD period, reducing investment risk. Generators will receive revenue from selling their electricity into the market as usual and will also receive a top-up to a pre agreed “strike price.” If the market price is greater than the strike price, the generator must pay back the difference. CfDs will operate alongside the Renewables Obligation (RO), which is the existing support scheme for large-scale renewable generation. The strike prices for initial EMR period have been set so that they are broadly comparable to the levels of support available under the RO, adjusted to account for the greater revenue certainty and shorter contract length provided by a CfD. In aggregate, consumers pay less under the CfD than under the RO as CfDs will reduce the risks faced by generators and improve the stability of their revenues.

There will be a transition period until March 31, 2017, during which the RO and CfD will both be open for applications from new renewable generating capacity. On March 31, 2017, the RO will close to new capacity and the CfD will be the sole support mechanism for new-generation applications. Accredited RO capacity will continue to be supported for a further 20 years, expiring in 2037.

|

Table 1 shows the strike prices and expected deployment by 2020 for the various renewable technologies. Wood pellets are currently used exclusively in the biomass conversion category, which is projected to be between 1.7 and 3.4 gigawatts of capacity by 2020 or about 7.6 per cent of the supported renewable technologies. Since Drax Power has already converted one boiler with 0.6 GW capacity and has announced intentions to convert two more for a total of 1.8 GW capacity, this leaves another 1.6 GW for other generators – presumably RWE Lynemouth and Eggborough Power. If all the capacity is converted as planned, this will mean an annual demand for some 13 million tonnes of wood pellets in the U.K. by 2020, up from about 2 million tonnes in 2013. Notably, at a strike price of £105/MWh, biomass conversions are less expensive than both offshore wind (at £155) and large-scale photovoltaic (at £120), both of which are expected to have more deployed capacity than biomass conversions.

The Capacity Market

The Capacity Market is designed to protect consumers against the risk of supply shortages and electricity price spikes. Each year, beginning in 2014, an auction will be held by the National Grid (U.K.’s system operator) for a delivery year four years hence. The four-year lead time is deemed to be the amount of time needed to plan and construct new generating capacity. Participation is also open to existing generators.

Where do we go from here?

On Dec. 4, 2013, the U.K. Department of Energy and Climate Change (DECC) sent draft investment contacts to Drax Power for the conversion of two additional 600 MW power units, to Eggborough Power for three 500 MW units, and to RWE Lynemouth Power for one 400 MW unit. Then, in an unusual move, on Dec. 19, 2013, DECC released a list of “provisionally affordable projects” omitting Eggborough Power from the list. Eggborough, with their local MP – Nigel Adams – are trying to understand this omission and to convince the energy minister to change the government’s decision.

So at the moment, it appears that only the two Drax units and one Lynemouth unit are set to go ahead with Eggborough being doubtful. Nevertheless, between Drax and RWE Lynemouth, conversion of three power units would represent about six or seven million tonnes of new wood pellet capacity annually. If Eggborough is able to work through its latest setback, conversion of its three units could account for another six million tonnes of wood pellets annually. We need to continue to offer our support to Eggborough.

Gordon Murray is executive director of the Wood Pellet Association of Canada. He encourages all those who want to support and benefit from the growth of the Canadian wood pellet industry to join. Gordon welcomes all comments and can be contacted by telephone at 250-837-8821 or by e-mail at gord@pellet.org.

Print this page