Global wood pellet markets

February 18, 2025

By William Strauss, president, FutureMetrics

2024 in review and thoughts on the next decades

Photo: © Irina / Adobe Stock

Photo: © Irina / Adobe Stock It has become traditional for FutureMetrics’ presentations at conferences to begin with a reminder of the urgency of the climate crisis. This article follows that tradition.

This article then proceeds to review current trends in the “industrial” pellet market. The article concludes with a brief discussion of the emerging use of biogenic carbon for refining iron ore in blast furnaces.

Ecological disequilibrium from the combustion of fossil fuels is overwhelming the Earth’s systems

Since industrialization the coal, petroleum, and methane (natural gas) that contains millions of years of sequestered carbon is being cycled out of the ground and into the air over a period of just a few hundred years.

There are consequences to the unmitigated use of fossil fuels. The energy trapping effects of increasing CO2 concentrations in the atmosphere means that both the atmosphere and the oceans are warming rapidly.

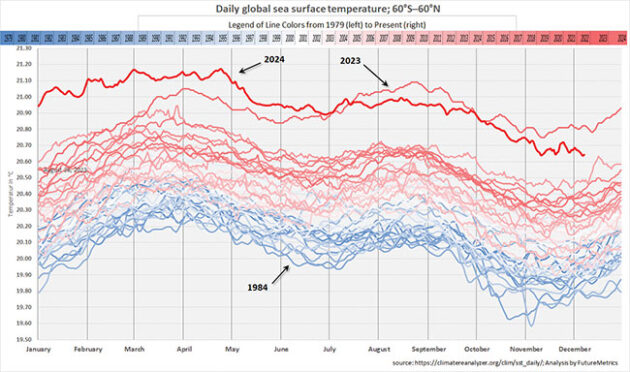

As Figure 2 shows, the oceans are getting warmer. But most troubling is the large changes seen in 2023 and continuing in 2024. Figure 2 shows not only rapid warming but it signals that we may have crossed a tipping point that results in even more rapid change combined with increasing variability (more extreme highs and lows).

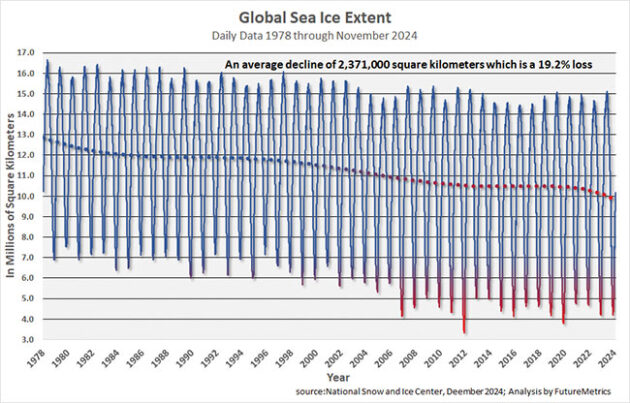

One of the many consequences of warming oceans and air is the increasingly rapid decline in sea ice in the Arctic Ocean and in the oceans surrounding Antarctica. As white ice disappears and open water takes its place, the radiative reflection rate declines, and more energy is absorbed by the water. This positive feedback loop accelerates the rate of ocean warming; and thus accelerates the rate of sea level rise and atmospheric warming.

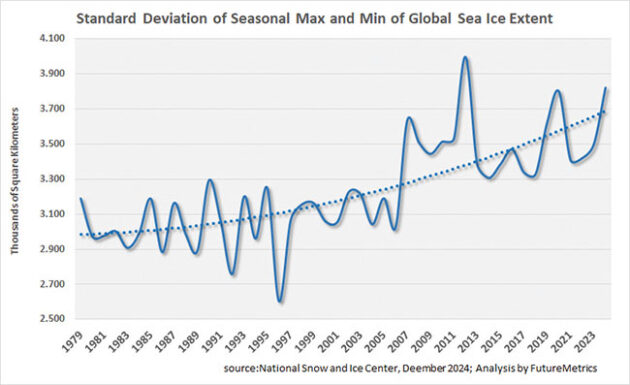

Figure 3 and Figure 4 show the steady loss of sea ice globally and the increasing variability between the seasonal maximums and minimums. From 1978 to November 2024, the average square kilometers of sea ice have fallen by 19 per cent. The seasonal minimum has fallen 39 per cent. The loss of sea ice is just one of many symptoms of the consequences of unabated greenhouse gas emissions. The imbalance in the carbon cycle can no longer be disconnected from global warming and induced climate change.

Pellet fuel for power generation is a critical part of the needed action

There is a strong and understandable reliance on the use of oil, gas, and coal. That reliance must be overcome.

When renewable energy is discussed, wind and solar generation are assumed to be the solution. They are, and they will be, an essential part of the future of power generation.

However, power generated from wind and solar sources has a serious shortcoming: no matter how many megawatts of solar and wind generation are deployed, sometimes they will generate less than the grid needs.

Over the next few decades, it is likely that energy storage solutions will be developed and deployed at a scale that will sufficiently buffer intermittent and variable supply and keep the power grids stable most (not all) of the time.

But to make the transition to a decarbonized future as seamless as possible, for at least the next few decades the power grids will need a significant quantity of CO2 beneficial generation that is on-demand and load-following.

The use of pellet fuel produced from perpetually renewing (nondepleting) bioresources solves part of that problem. Existing coal-fueled utility power stations can, with relatively low cost and little downtime, make modifications and replace coal with upgraded densified biomass-derived solid fuel (called “pellet” fuels) produced from perpetually renewing (not depleting) sources.

The result is renewable electricity that can be generated on demand.

Pellet fuels replacing coal in 2024 and beyond

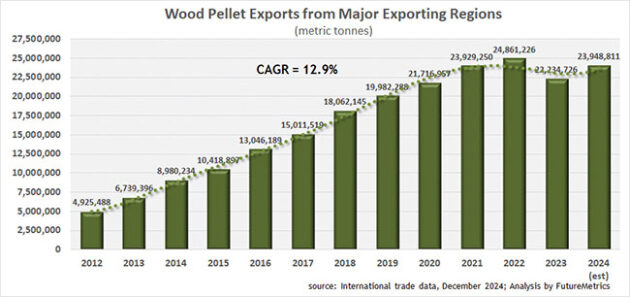

The industrial pellet fuel sector had, until 2023, seen steady growth. Figure 5 shows that even with the estimated dip in exports in 2023, over the last 13 years the export market has grown at a compounded annual growth rate of 12.9 per cent per year.

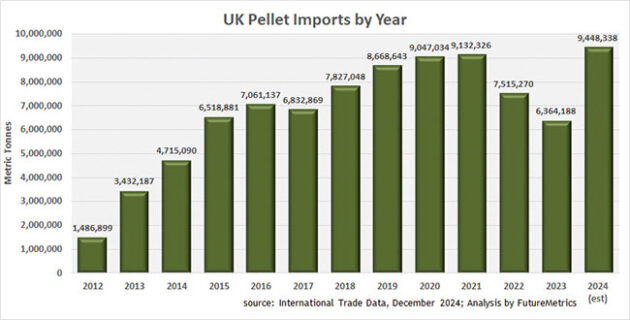

The dip in 2023 was due to a combination of reasons. The primary reason is due to a significant drop in demand in the U.K. (see Figure 6 – U.K. pellet fuel imports by year.) due to the reduction in pellet fuelled generation at the Drax and Lynemouth power stations. High power prices, high pellet spot prices, and characteristics of the U.K. policy called the “contract for difference” (CfD) temporarily made it uneconomical to use pellet fuel to produce electricity in CfD supported units. Power market conditions in the U.K. corrected in the first half of 2024 and generation rates are again at nominal capacity levels.

In fact, FutureMetrics estimates that the U.K. will have its highest year in history for pellet imports in 2024 (see Figure 6 – U.K. pellet fuel imports by year.).

The U.K. will soon announce a so-called “bridge” policy that, along with defining support for pellet fueled power generation into the 2030’s, will improve how the CfD prices are determined. It is expected that U.K. pellet fuel demand will remain strong in 2025 and into the 2030’s. The expectation is that both major power stations will have bioenergy carbon capture and storage (BECCS) deployed and operating in the first half of the 2030’s. The expected revenue from negative carbon emissions will be sufficient to allow the U.K. to phase out the CfD for power sales.

Global trade of pellet fuel between all countries is expected to exceed 25 million tonnes in 2025. Figure 7 – Wood pellet exports by region., shows the major exporting regions’ exports since 2012.

North America is by far the largest producer and exporter of industrial pellet fuel. North American exports remain on a steady growth trajectory (see Figure 8 – Quarterly exports from the U.S. and Canada.).

The recent financial collapse of the world’s largest pellet fuel producer, U.S.-based producer Enviva, is not expected to impact the production of pellets at most of Enviva’s existing plants. Enviva announced that it emerged from Chapter 11 bankruptcy on December 6, 2024, as per approval by the court. Until the Epes factory is operating, it is possible that Enviva’s aggregate existing production capacity in the U.S. may decline slightly if a few of Enviva’s least profitable plants are closed.

Canadian exports have pivoted from the U.K. to Japan (see Figure 9 – Canadian exports to the U.K. and Japan.). This is a long-expected change that optimizes western Canadian export logistics and the evolution of long-term supply agreements. It is expected that notwithstanding the reversal in trend in 2024, that the majority of western Canadian production will move into the Asian markets.

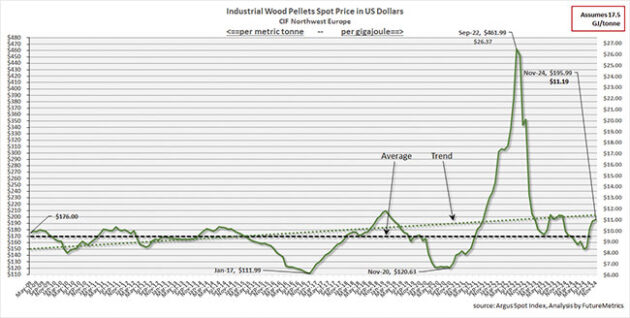

The industrial pellet spot prices reported by Argus provide valuable information regarding supply and demand relationships and expectations. The Argus spot price index is based on northwest Europe (sometimes called ARA for Amsterdam, Rotterdam, and Antwerp). But spot prices do not reflect the actual prices being paid for most of the pellets being imported. The generally accepted assumption is that about 80 per cent, or so, of pellets are traded under long-term agreements at set prices that are independent of the spot price.

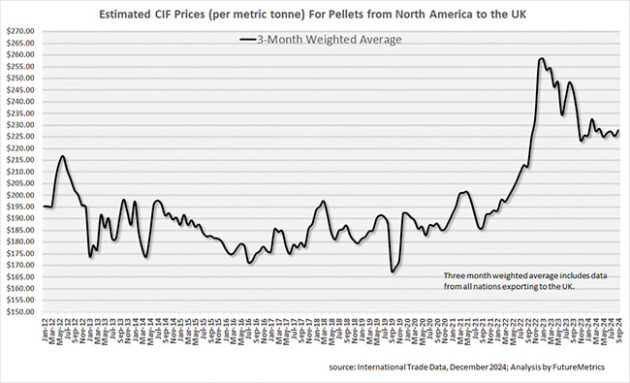

FutureMetrics uses monthly trade data to estimate the average price per tonne for pellets crossing the border into the major importing countries. Figure 10 – Price paid for pellets imported into the U.K.. shows the estimated price per tonne paid for pellets crossing into the U.K.

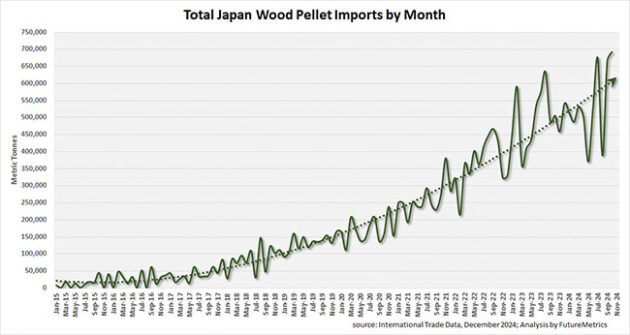

FutureMetrics expects imports into Japan to increase substantially in the next 5 years. Past steady growth in demand (see Figure 11 – Monthly imports into Japan.) is expected to continue.

FutureMetrics expects continued growth in the Japanese markets. In general, Japan’s goals for decarbonization of the power sector and their need for reliable steady power will result in a steady increase in power generated from sustainable pellet fuels.

Japan’s requirements for sustainability certification that will become required in 2025 may influence how pellets fuels are sourced. Currently, Vietnam has the majority of the Japanese market share for imported pellet fuel (see Figure 12 – Origins of pellets imported into Japan.).

The estimated average price paid for pellets in Japan is unlikely to fall to the lows seen from 2016 to 2021 (see Figure 13 – Price paid for pellets imported into Japan.). Suppliers’ costs of production have increased and sustainability requirements will exclude some producers.

The independent power producers in Japan that are supported by the feed-in-tariff (FiT) have a price ceiling set by the FiT. The FiT rate is high enough to afford to pay for higher priced pellets in the short and possibly medium terms. But given that the FiT price is fixed for 20 years (no annual change), and depending on cost and price inflation expectations, the lengths of Japanese agreements going forward will be shorter and the basis starting price per tonne will be higher.

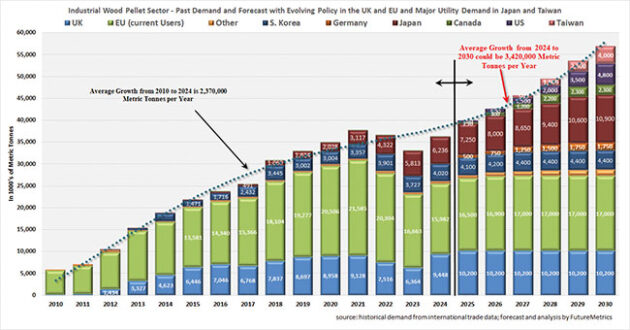

FutureMetrics expects that future demand growth for pellet fuel could be significant. While Europe and the U.K. are expected to plateau, there is potential for new demand in Germany, Poland, Canada, the U.S., and Taiwan. There is potential for total pellet fuel demand to grow at an annualized rate of about 3.4 million tonnes between 2025 and 2030 (see Figure 14 – Industrial pellet demand forecast to 2030.). However, if those expectations are to come true, policy will have to evolve and that will require continued education and advocacy at the policy making levels.

Final thoughts: Biogenic carbon replacing geologic carbon

Within the limits defined by the renewal rate for global working forests and other crops dedicated to sustainably converting solar energy and CO2 into carbohydrates, uses for the bioresources other than as fuel for making heat and power are emerging.

For example, the supply chains and infrastructure that converts bioresources into homogenized densified pellets and delivers them to users around the globe is well-suited for a major CO2 emitting sector: steelmaking. Demand for highly carbonized biomass as a reductant in steelmaking is expected to ramp up significantly. For a detailed discussion on this topic, see the recent FutureMetrics whitepaper at:

www.futuremetrics.info/FutureMetrics/WhitePapers/SteelMaking/FutureMetrics%20-%20Using%20Highly%20Carbonized%20Bioresources%20for%20Steelmaking%20-%20Oct%2015%202024.pdf.

Over the next few decades, the need for on-demand thermal generation will plateau and eventually decline. But the demand for higher value biogenic carbon will increase. The future for the industrial pellet sector is bright. •