Global Wood Pellet Markets: 2023 in review and why industrial wood pellets are key for the future

January 8, 2024

By William Strauss

Pellet exports – overall market aggregated.

Pellet exports – overall market aggregated. By William Strauss, PhD, president, FutureMetrics

This article begins with a reminder of the severity of the climate crisis, then proceeds to review trends in the “industrial” pellet market in which pellet fuel is supplied to large scale heat and power stations to replace coal.

Fossil fuels have been critical to civilization’s growth but are also the cause of ecological disequilibrium

Since industrialization, over a period of a few hundred years, the coal, petroleum, and methane (natural gas) that contains millions of years of sequestered carbon is being cycled out of the ground and into the air.

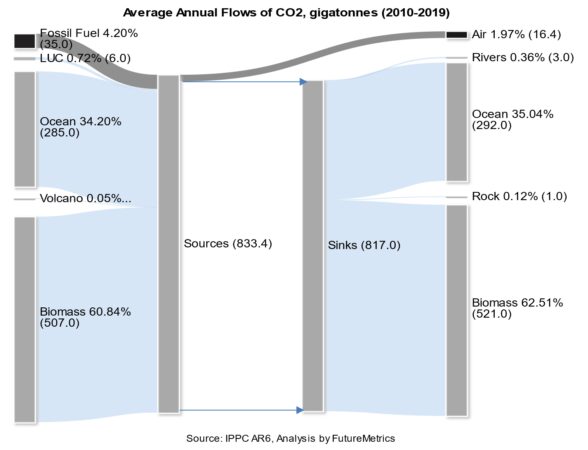

As a result, the earth’s systems are critically out of balance. As Figure 1 shows, the earth’s systems are unable to fully recycle the carbon dioxide (CO2) emitted from the use of fossil fuels.

Sources now exceed sinks; and this disequilibrium condition will persist if humankind continues to do business as usual.

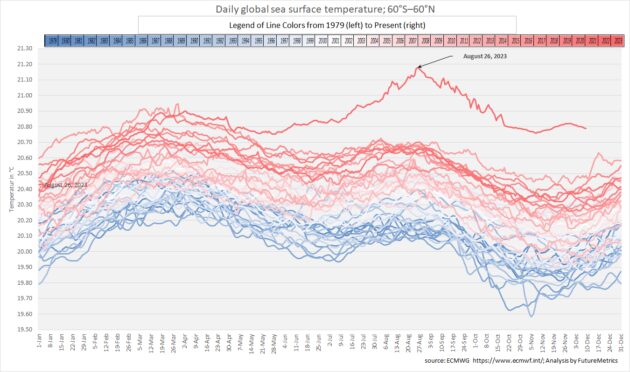

There are clear and present consequences to the unmitigated use of fossil fuels: The release in just a few hundred years of carbon that was stored over many millions of years is causing rapid changes to the earth’s systems balance. For example, as Figure 2 demonstrates, the oceans have been steadily warming. But most troubling is the excursion seen in 2023.

There are many metrics showing that fossil fuel CO2 emissions are causing rapid changes in environmental variables. Figure 2 shows not only steady warming but it signals that in 2023 we may have crossed a tipping point that results in even more rapid change combined with increasing variability (more extreme highs and lows).

The message the earth is sending should be loud and clear. In some jurisdictions it is listened to. In some it is ignored or denied.

The imbalance in the carbon cycle can no longer be disconnected from climate change. If the future is going to be what we hope it will be, action is needed now.

Pellet fuel is a critical part of the needed action

There is a strong and understandable reliance on the use of oil, gas, and coal that has to be overcome. The great leap upward in overall standards of living is directly related to industrialization and the use of concentrated and easily transported energy carriers. Today’s socioeconomic systems are based on the energy we derive from fossil fuels.

When renewable energy is discussed, wind and solar generation are assumed to be the solution. They are, and they will be, an essential part of the future of power generation.

However, power generated from wind and solar sources has a serious shortcoming: No matter how many megawatts of solar and wind generation are deployed, sometimes they will generate less than the grid needs.

Over the next few decades, it is likely that energy storage solutions will be developed and deployed at a scale that will sufficiently buffer intermittent and variable supply and keep the power grids stable most (not all) of the time. But to make the transition to a decarbonized future as seamless as possible, the power grids will need CO2 beneficial generation that is on-demand and load-following.

The use of pellet fuel produced from perpetually renewing biomass solves part of that problem. Existing coal-fuelled utility power stations can, with relatively low cost and little downtime, make modifications and replace coal with upgraded densified biomass-derived solid fuel (called “pellet” fuels) produced from perpetually renewing (not depleting) sources. The result is renewable electricity that can be generated on demand.

What the world is doing now shows us a pathway for the future

This review is focused on the industrial sector in which large utility power stations have already successfully completed “bioconversions.” For them coal is history; but dispatchable or baseload generation is not.

Pellets are used in two primary sectors: for heating at relatively small scale in homes and businesses using stoves and boilers, and for replacing coal in large scale heat and power generation. These markets are commonly called “heating” markets, and “industrial” markets[1].

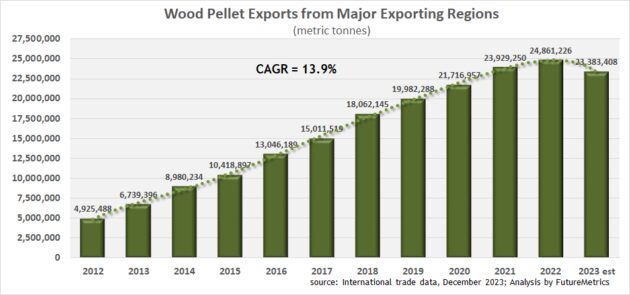

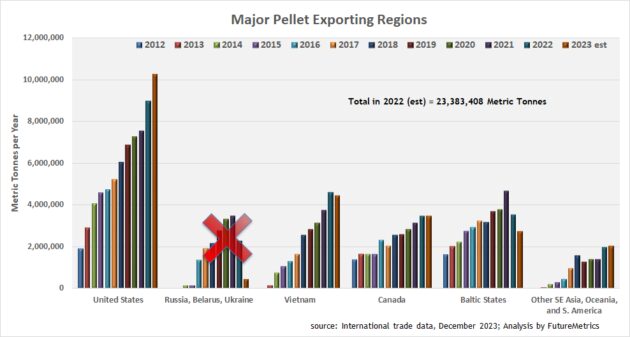

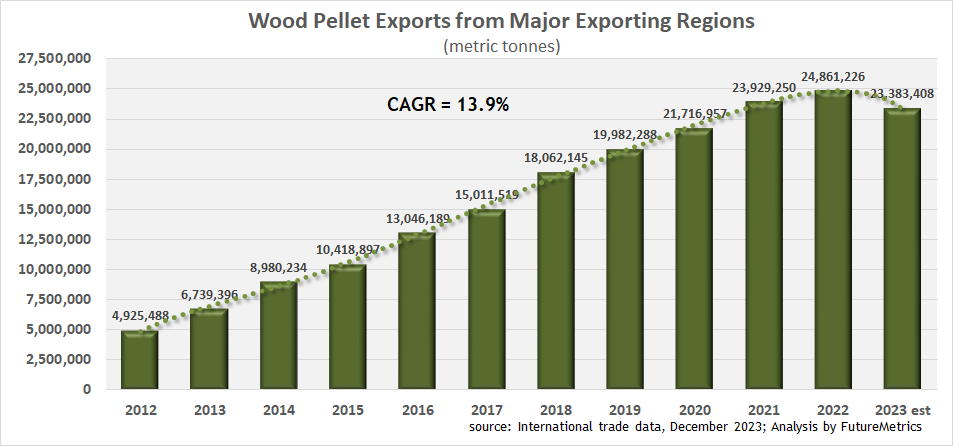

The industrial pellet fuel sector has, until 2023, seen steady growth. Figure 3 shows that even with the estimated dip in exports in 2023[2], over the last 12 years the market has grown at a more or less steady 14 per cent per year.

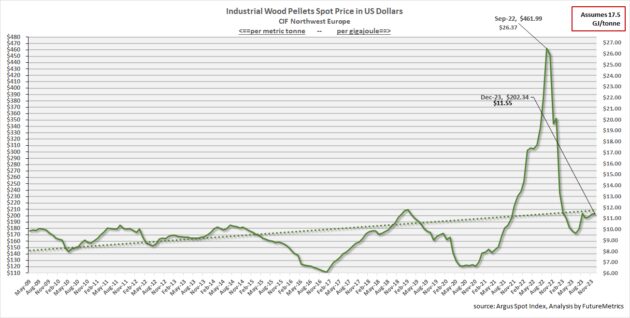

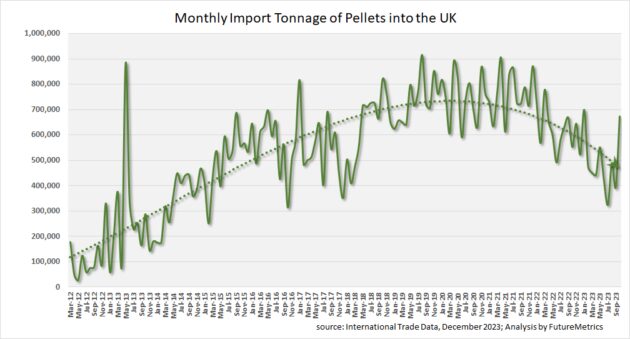

The dip in 2023 is due to a combination of reasons. The primary reason is due to a significant drop in demand in the U.K. (see Figure 8) due to the reduction in pellet fueled generation at the Drax and Lynemouth power stations. High power prices, high pellet spot prices (see Figure 4), and shortcomings in the UK policy called the “contract for difference” (CfD) temporarily made it uneconomical to use pellet fuel to produce electricity on CfD supported units.

Power market conditions have corrected, and it is expected that U.K. demand will return to normal, and then some. The long delayed MGT station is expected to be at full capacity in 2024. That will add an additional one million metric tonnes or so of demand to the U.K. markets.

Supply disruptions in the Baltic states and the loss of most E.U. imports of pellets from Russian, Belarus, and Ukraine (see Figure 5) were expected to create significant shortages. The spot markets in 2022 reflected this expectation. However, the U.K. drop in demand combined with an unusually warm winter in Europe balanced the supply disruptions.

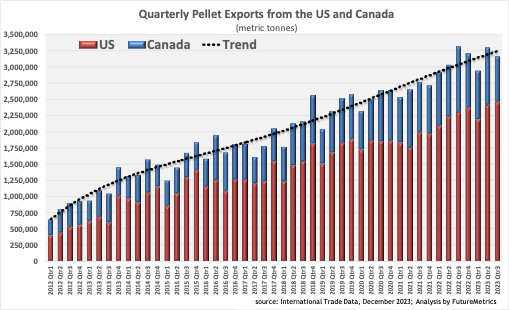

North American exports remained on a steady growth trajectory (see Figure 6).

Figure 6 – Quarterly exports from the U.S. and Canada.

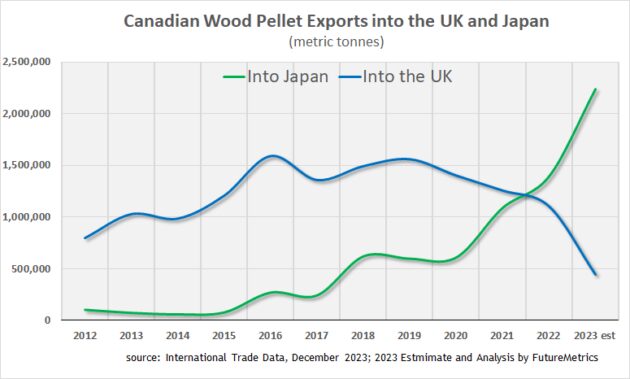

Canadian exports have pivoted from the U.K. to Japan (see Figure 7). This is a long-expected change that optimizes western Canadian export logistics and the evolution of long-term supply agreements.

England (U.K.) imports, as noted above, have dipped. FutureMetrics expects the U.K. demand to return to about 10.2 million tonnes per year in 2024.

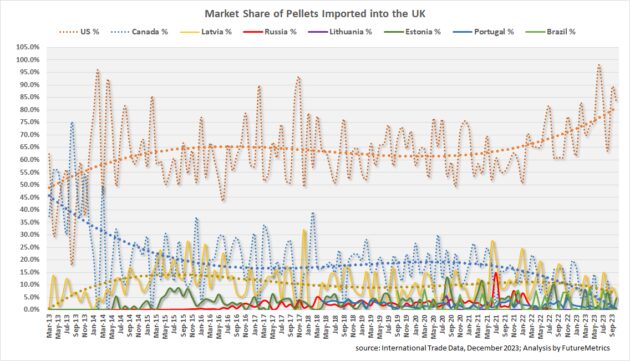

As U.K. demand dipped, the U.S. increased its market share of pellet imports into the U.K. (see Figure 9).

The industrial pellet spot prices reported by Argus provide valuable information regarding supply and demand relationships and expectations. The Argus spot price index is based on northwest Europe (sometimes called ARA for Amsterdam, Rotterdam, and Antwerp). But spot prices do not reflect the actual prices being paid for most of the pellets being imported. The generally accepted assumption is that about 80 per cent or so of pellets are traded under long-term agreements that set prices that are independent of the spot price.

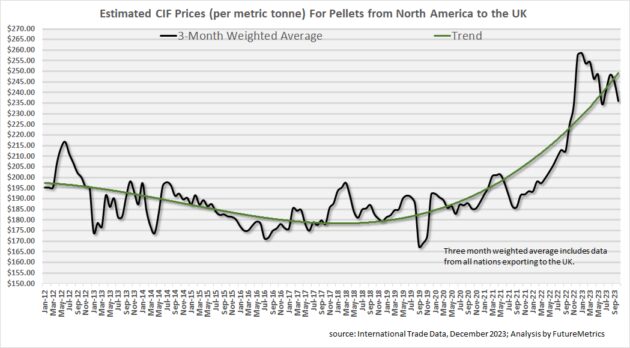

FutureMetrics uses monthly trade data to estimate the average price per tonne for pellets crossing the border into the major importing countries. Figure 10 shows the estimated price per tonne paid for pellets crossing into the U.K.

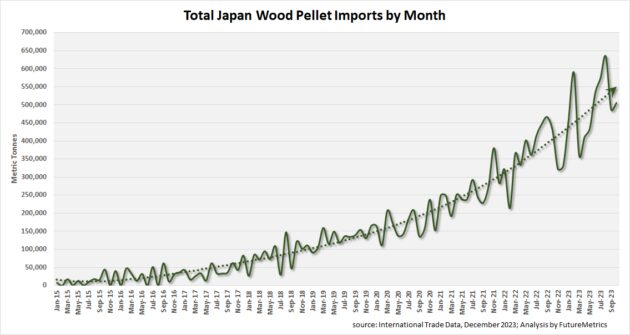

Unlike the U.K., Japan has seen steady growth in demand. Figure 11 shows this trend.

FutureMetrics expects continued growth in the Japanese markets. The reasons are discussed in detail in the report referenced in footnote 1. In general, Japan’s goals for decarbonization of the power sector and their need for reliable steady power will result in a steady increase in power generated from sustainable pellet fuels.

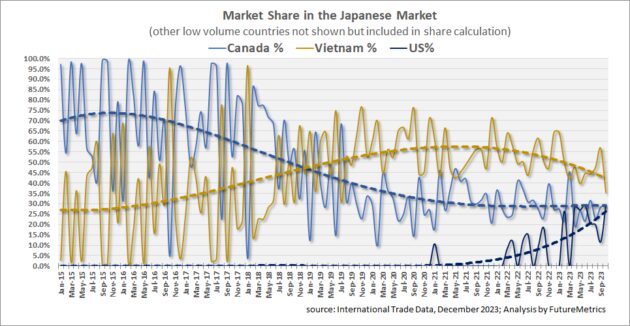

Japan’s requirements for sustainability certification that kick in in 2024 will influence how pellets fuels are sourced. Already there is a trend in the market shares of pellet fuel suppliers that is favorable for north American suppliers (see Figure 12).

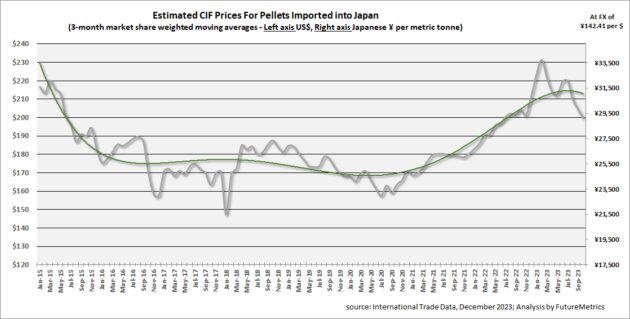

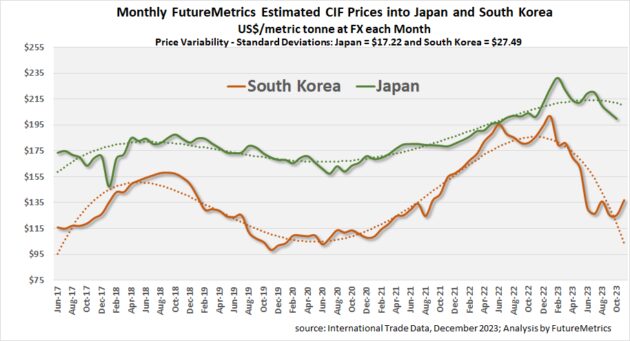

The estimated average price paid for pellets in Japan is unlikely to fall to the lows seen from 2016 to 2021 (see Figure 13). Suppliers’ costs of production have increased. For a supply agreement to be sustainable, neither side of the contract can consistently lose money.

The independent power producers in Japan that are supported by the feed-in-tariff (FiT) have price ceiling set by the FiT. The FiT rate is high enough to afford to pay for higher priced pellets in the short and possibly medium terms. But given that the FiT is fixed for 20 years, and depending on cost and price inflation expectations, the lengths of Japanese agreements will be shorter is the basis starting price per tonne is higher.

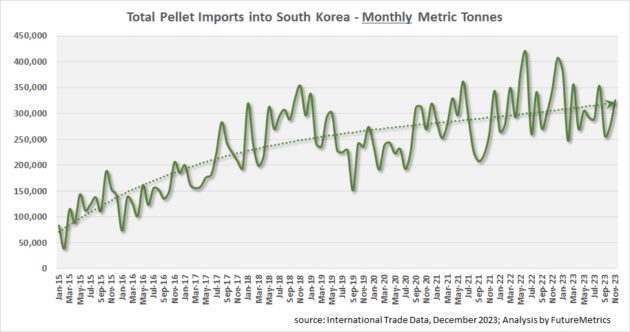

South Korea is the last of the current major importers to be covered in this discussion. Policy in S. Korea is such that future demand for pellet fuel is highly uncertain. The large utility power stations that co-fire pellet fuel under S. Korean policy cannot know what the economics of using pellet fuel will be even one year in advance. Thus, there are almost no long-term agreements for pellet fuel supply. The S. Korean market is almost a spot market.

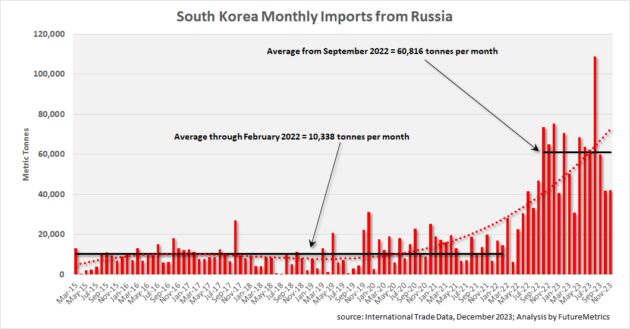

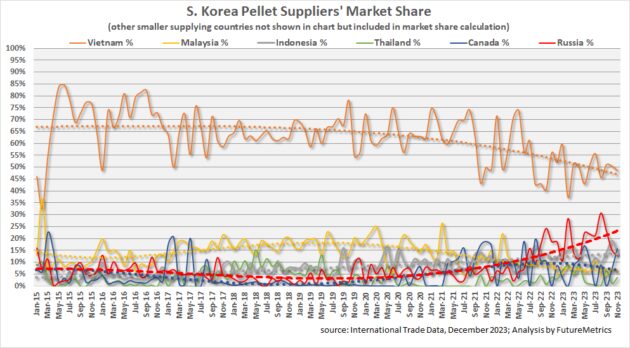

Supply to that market has been dominated by Vietnam (see Figure 16). Since the sanctions on Russian good turned off Russian exports to Europe and Japan, South Korean imports of Russian pellets have increased significantly (see Figure 14).

The average price paid for pellet fuel into South Korea is highly variable. Figure 17 compares Japan and South Korean estimated delivered pellet prices.

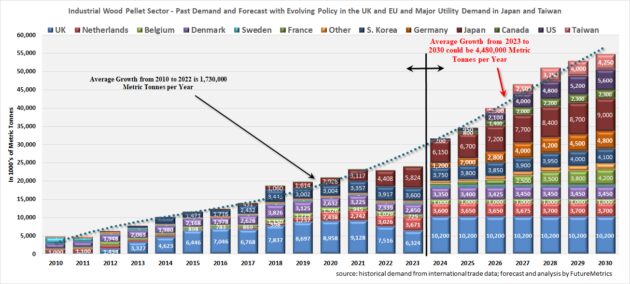

FutureMetrics expects future demand growth for pellet fuel to be robust. While Europe and the UK are expected to plateau (unless Germany and Poland switch course on policy regarding pellet fuels for power generation), Canada, the US (unless it to switches policy the wrong way under a Republican administration), and Taiwan are expected to see major utilities replace coal with pellet fuels. There is potential for the markets to grow at an increase in annual demand greater than 4 million tonnes per year (see Figure 18).

Taiwan is particularly interesting. Their industrial pellet imports were essentially zero in 2022 (about 5,000 tonnes). But that is expected to change as the decade progresses. A recent report by the USDA Foreign Agricultural Service[3] notes that one major utility has announced the bioconversion of a coal station and expects it to demand about 1.7 million tonnes per year of pellet fuel.

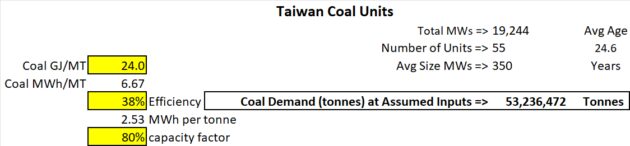

Taiwan has 55 coal fuels units using an estimated 53 million tonnes per year of coal (see Table 1). A significant proportion of the units are relatively new (under 25 years old). FutureMetrics expects to see Taiwanese demand become a significant part of global demand in the second half of the decade.

FutureMetrics has prepared a Google Map of the Taiwanese coal fired units HERE.

Interest in sectors other than power generation is also growing. Several major metals mining companies are seriously exploring the use of sustainably sourced carbon beneficial biomass-derived pellet fuel for process heat in their refineries. Demand for highly carbonized torrefied biomass as a reductant in steelmaking is expected to ramp up.

Total demand in 2023 for pellets in both the existing heating and industrial sectors is expected to be about 44 million tonnes. If the U.K. goes back to normal and the MGT project in the U.K. ramps up as expected, if Japan’s growth continues as expected, and if the northern hemisphere winter has a normal number of heating degree days in the current heating season, 2024 heating and industrial pellet demand could be about 53 million tonnes.

If this forecast for 2024 is in the ballpark, without the historical imports from Russia, the pellet markets have a strong potential to be short of supply. If that happens, once inventories are depleted, spot prices will likely see another significant rise.

[1] Detailed information and analysis about the global pellet markets is contained in FutureMetrics’ Global Pellet Markets report. View the table of contents and lists of figures and tables HERE.

[2] Trade data for 2023, as of the writing of this article, was incomplete for the year. Depending on the nation, data was available through October and November. Total values for all of 2023 are estimated by FutureMetrics.

Print this page